What is Retail Finance?

Retail Finance lets your customers spread the cost of a purchase over time in smaller instalments. With Zopa we offer 3 to 60 months. It’s an excellent way to boost sales, increase average order value and win new customers.

Merchants who have added retail finance as a payment option both online and instore experience a revenue uplift, while their customers are able to access higher-ticket items more affordably therefore leading to higher average order values (AOV).

Watch our brief showreel to see how our solutions are delivering results for a wide range of UK merchants.

What’s the best finance option for me?

Zopa’s retail finance solution, DivideBuy, offers a range of interest free and interest bearing credit products to choose from.

Our finance products range from 3-60 months, depending on your customer and business needs. You can set minimum spend thresholds for longer terms, increasing average order values and protecting your margins.

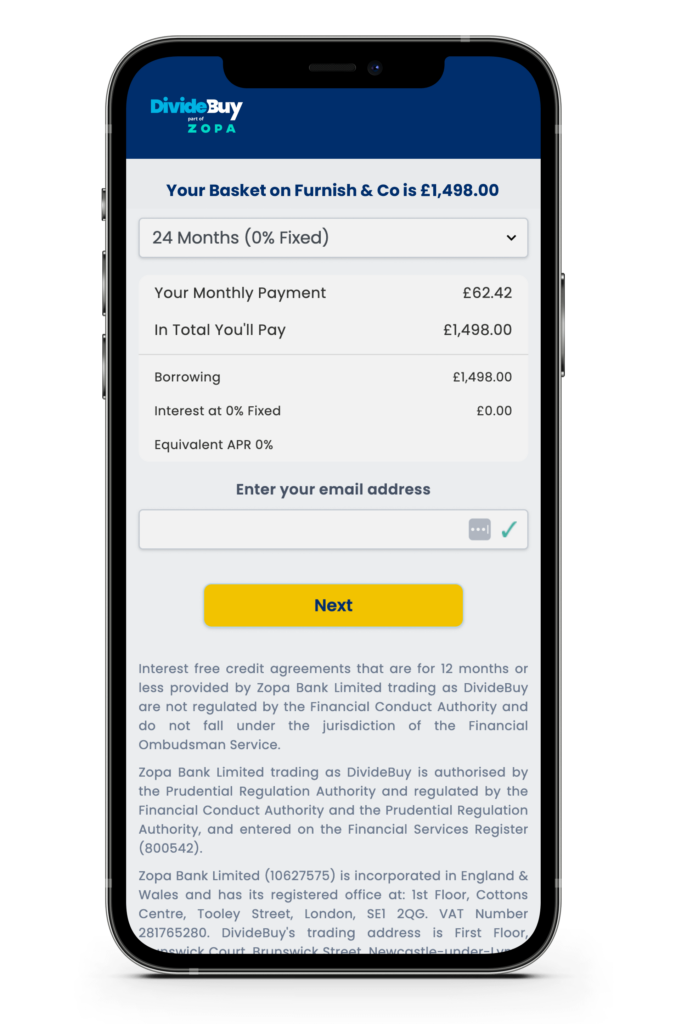

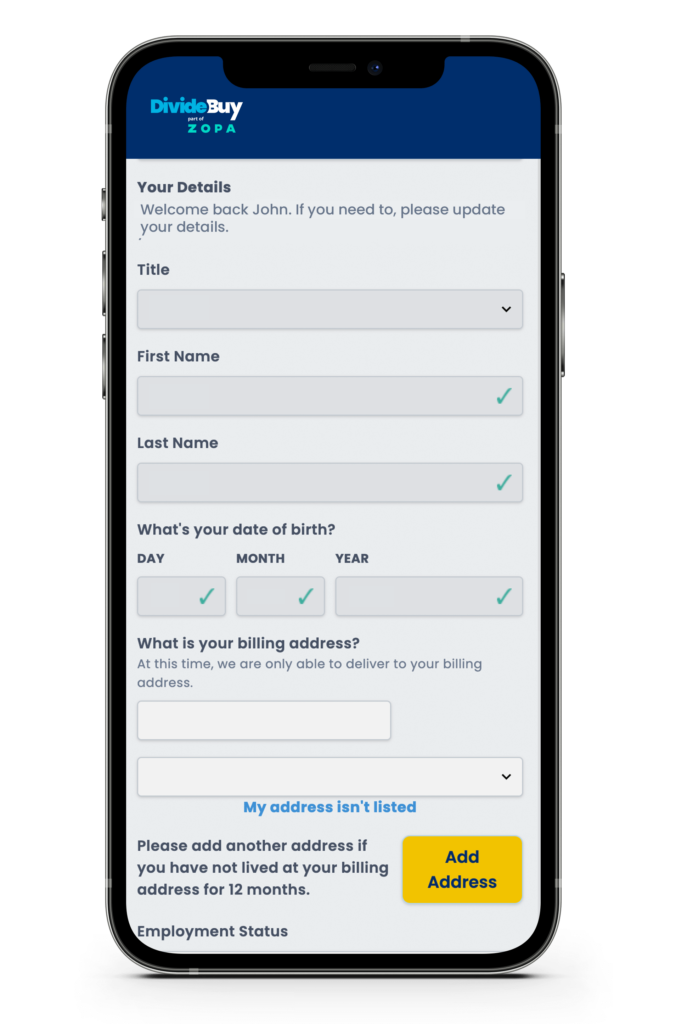

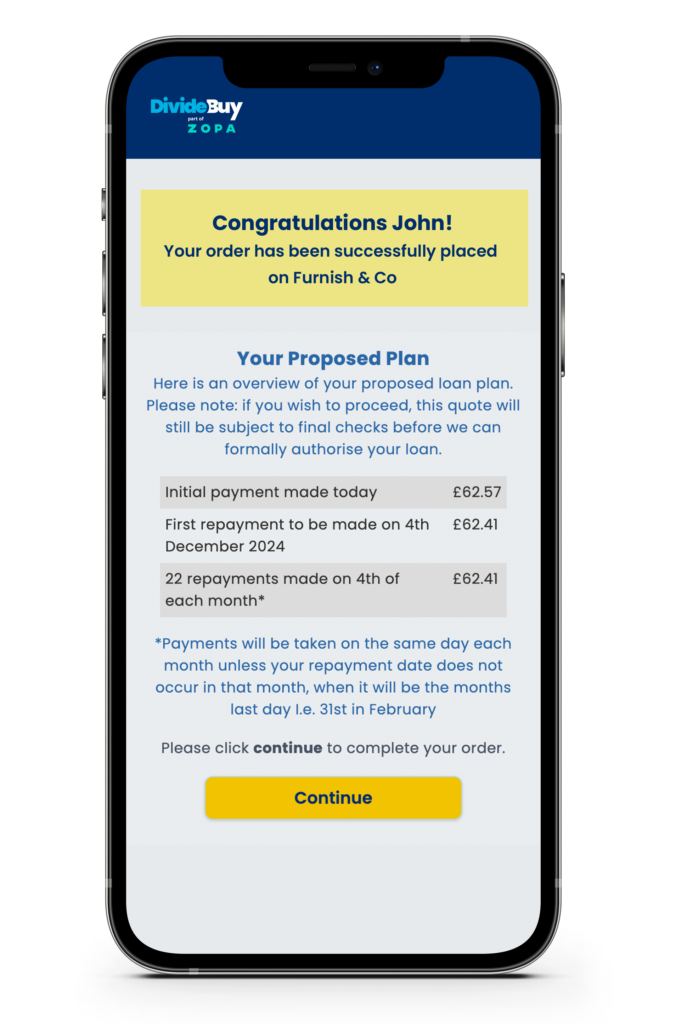

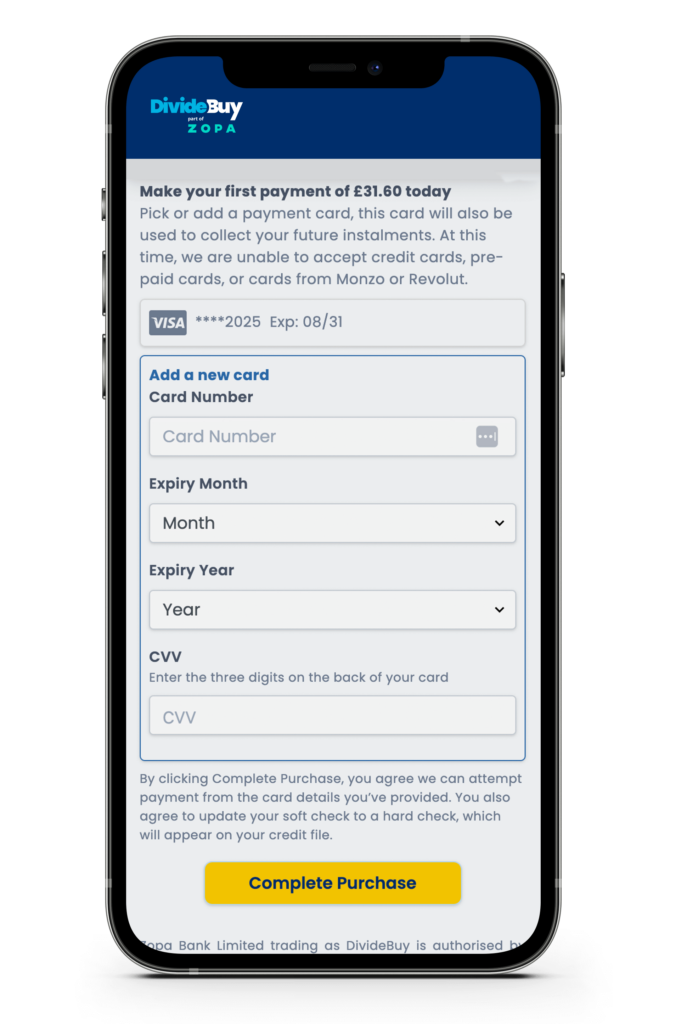

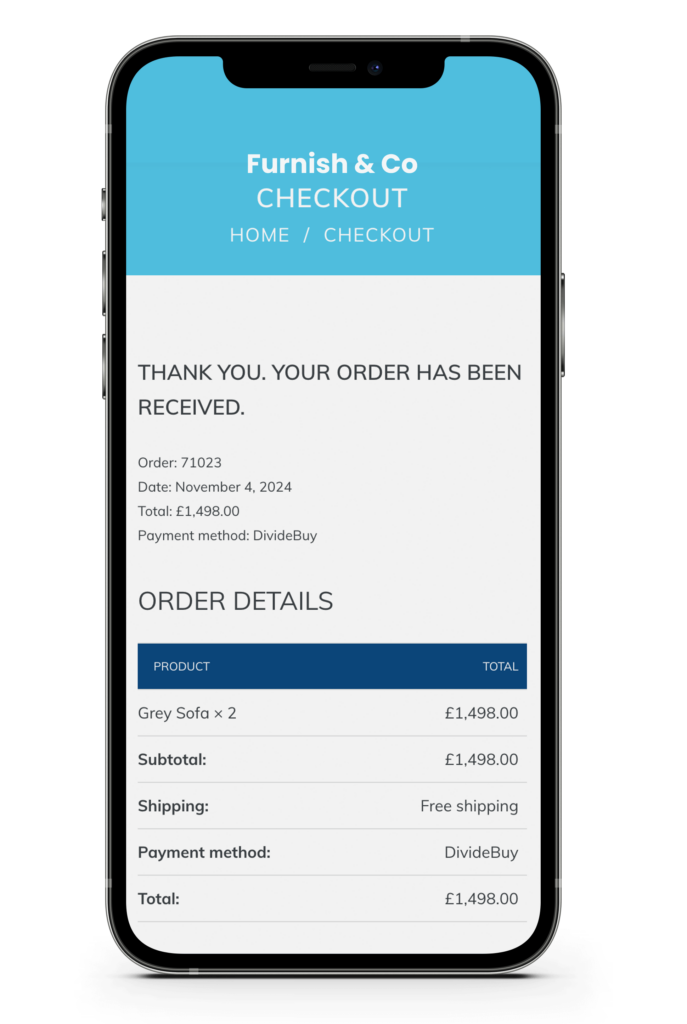

How does Retail Finance work?

We provide both the technology and lending capabilities for your solution, meaning we handle every aspect of your integration. Whether its via a platform app, API or headless solution, we’ve got it all covered.

How can retail finance help my business?

Zopa’s finance solution is helping hundreds of UK merchants to significantly increase average order values and conversions, while lowering cost per acquisition (CPA) and cart abandonment.

When choosing Zopa as your trusted retail finance partner, you also benefit from tailored reporting that offers practical insights for growth – all powered by your dedicated account manager.

Book a Demo

Our credit engine is so seamless, we can demo our solution in minutes. Experience our transformative customer journey in real-time and book a slot with our experts now.

What our merchants say

Read more about how we’re delivering results for merchants in your sector

There was no lounging about on sales for Furniture Maxi with our retail finance solutions.

How we helped Swyft increase revenue by 65% with A/B testing for optimised credit sales.

How we drove a 29% conversion increase for Nectar thanks to retail finance.

Try our Approval Calculator

Try our Approval Calculator

Watch & learn

Watch & learn