Retail Finance Explained

The best place to find information about retail, embedded and point-of-sale finance.

Retail finance (or point of sale finance) is a payment option which lets consumers spread the cost of a purchase over a series of smaller instalments.

Read moreThere are various retail finance options available to merchants – but how do you know which is the right one for your business?

Read moreWhether you’re new to finance or considering a change in provider, use this practical list to tick all the right boxes – and find the best lending fit for your business.

Read moreRetail Finance is different than Buy Now Pay Later, which is typically short-term, interest free borrowing like Pay in 3 or Pay in 6 months plans.

Read moreThere are a whole range of Retail Finance options to choose from for your business. However, these can ultimately be grouped into two categories: regulated and unregulated finance.

Read moreIntegrating a retail finance product into your eCommerce checkout can be a quick and effective way of adding ‘spread the cost’ options as a payment method for customers.

Read moreOnce you’ve got your retail finance solution up, be sure to keep your foot on the pedal so you can capitalise on its success.

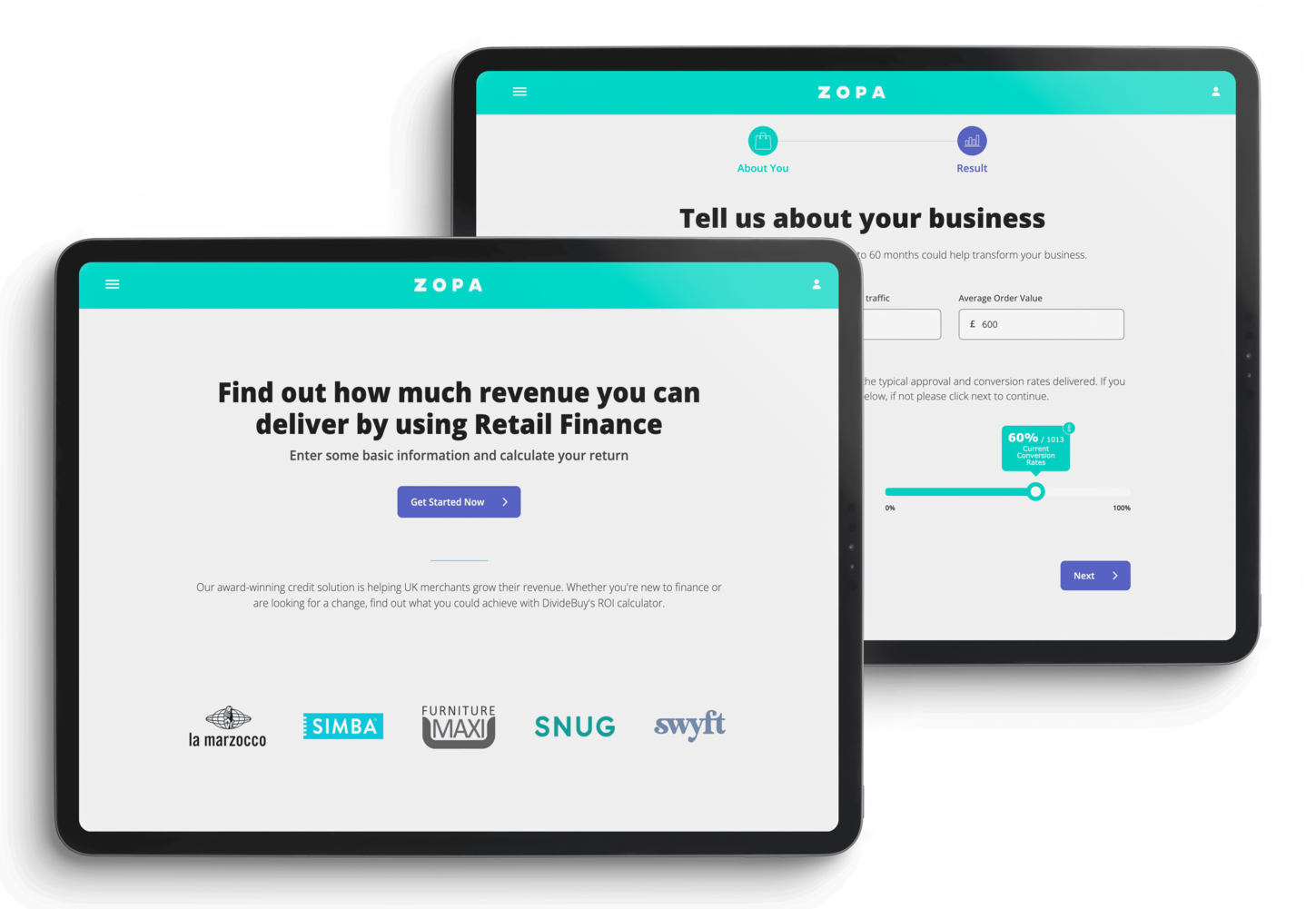

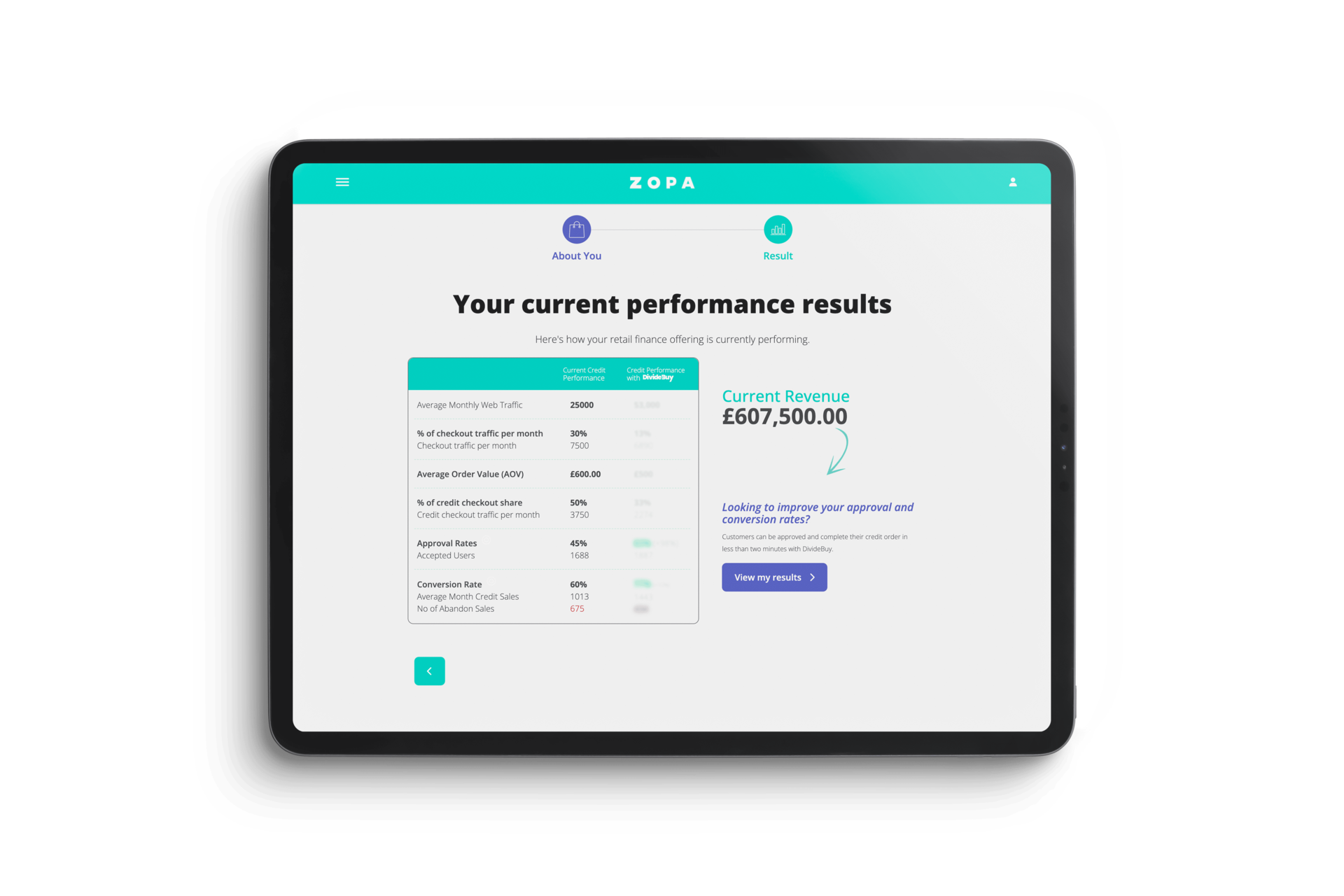

Read moreOur award-winning retail finance solution is helping UK merchants boost their revenue. Whether you’re new to finance or are looking for a change, find out what you could achieve with our Revenue Calculator.

Book a Demo

Our credit engine is so seamless, we can demo our solution in minutes. Experience our transformative customer journey in real-time and book a slot with our experts now.

Try our Approval Calculator

Try our Approval Calculator