What is interest free credit?

In Retail Finance, interest free credit is a shopping cart plugin payment option that enables customers to the spread the cost of goods and purchases over a set period of time, with no interest charged if the balance is cleared on time.

Interest free finance under 12 months isn’t currently regulated by the Financial Conduct Authority in the UK, so its important to partner with a provider like Zopa that follows FCA guidance.

If you’re looking for 0% finance which extends past 12 months, you’ll need a finance provider that’s regulated by the FCA and who can help you with the necessary permissions.

How does Retail Finance work?

We provide both the technology and lending capabilities for your solution, meaning we handle every aspect of your integration. Whether its via a platform app, API or headless solution, we’ve got it all covered.

More sales, less risk

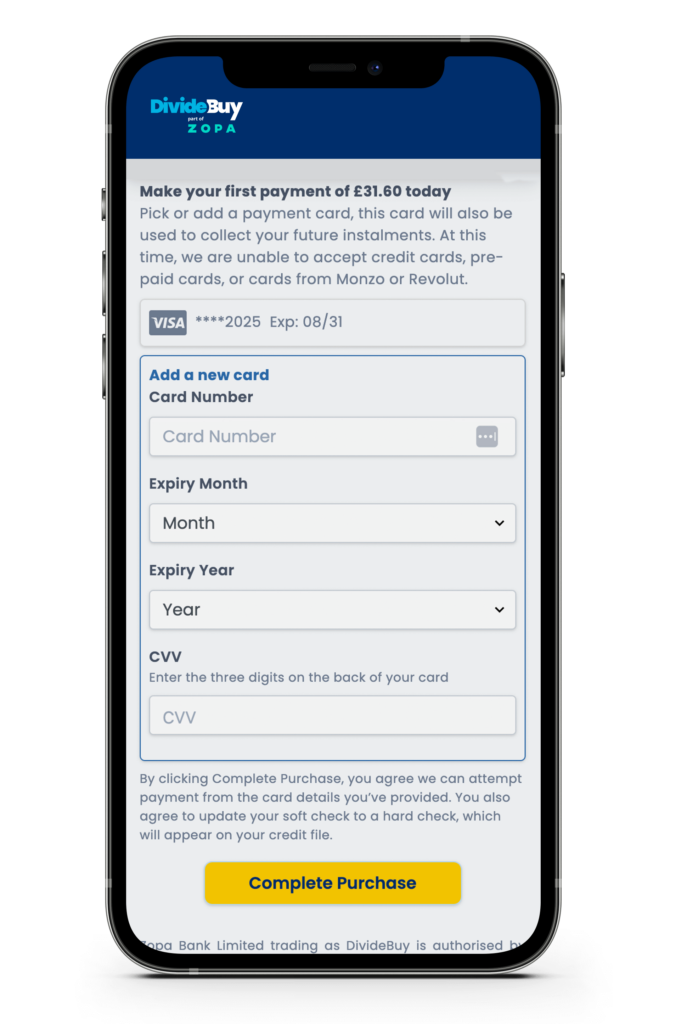

Our Conversion Suite of tools helps your customers access 0% finance safely and responsibly. With our Eligibility Checker widget, shoppers can see whether they’re likely to be approved for finance, without harming their credit score.

As a regulated lender, we work with our merchants to ensure you’re complying with national guidance from the Financial Conduct Authority – protecting you, your business and your customers.

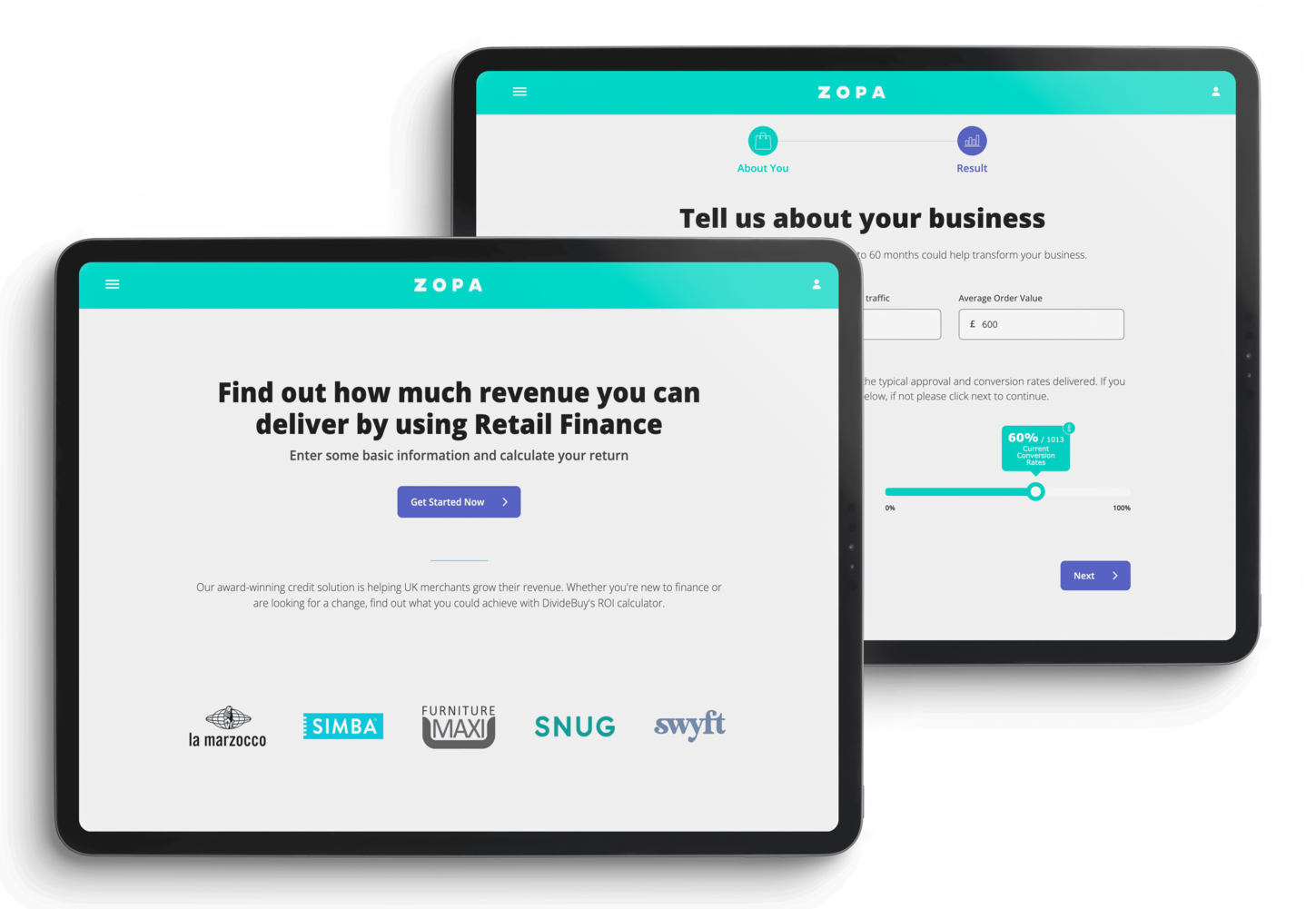

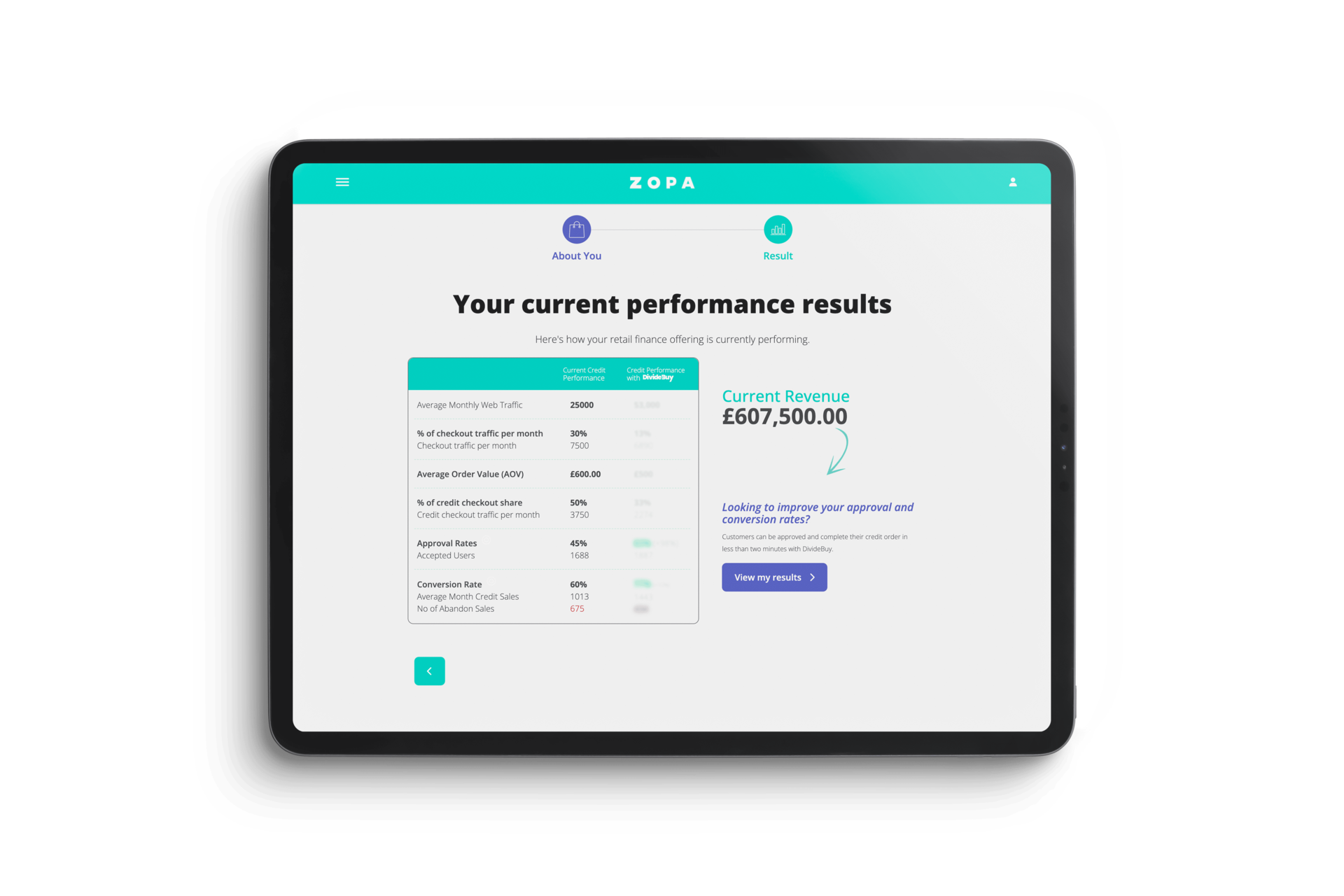

Our award-winning retail finance solution is helping UK merchants boost their revenue. Whether you’re new to finance or are looking for a change, find out what you could achieve with our Approval Calculator.

How does interest free credit work for businesses?

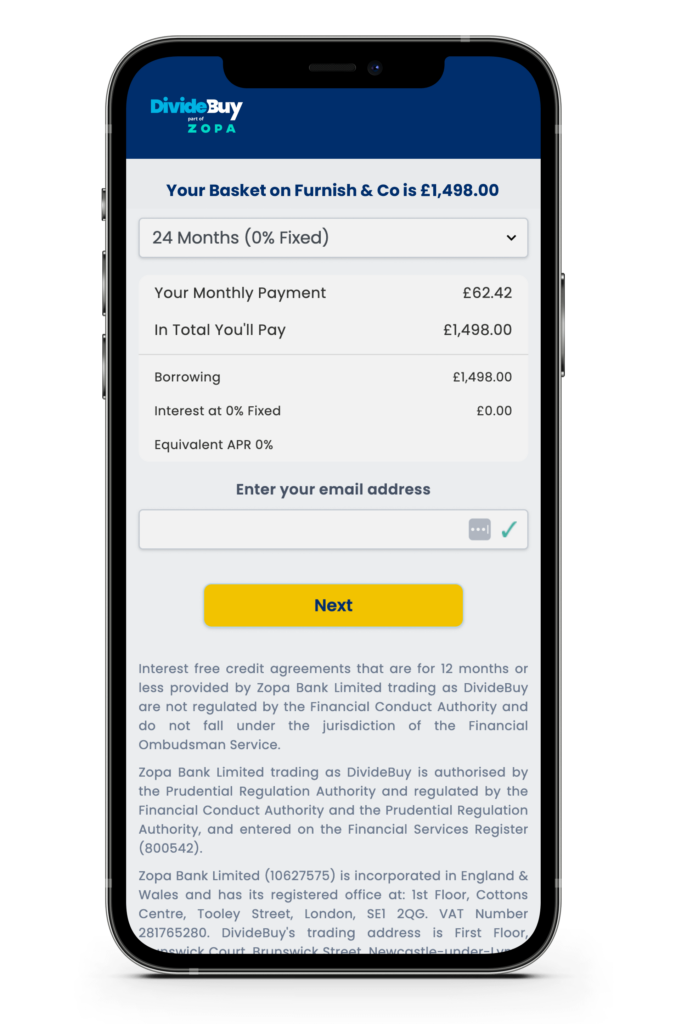

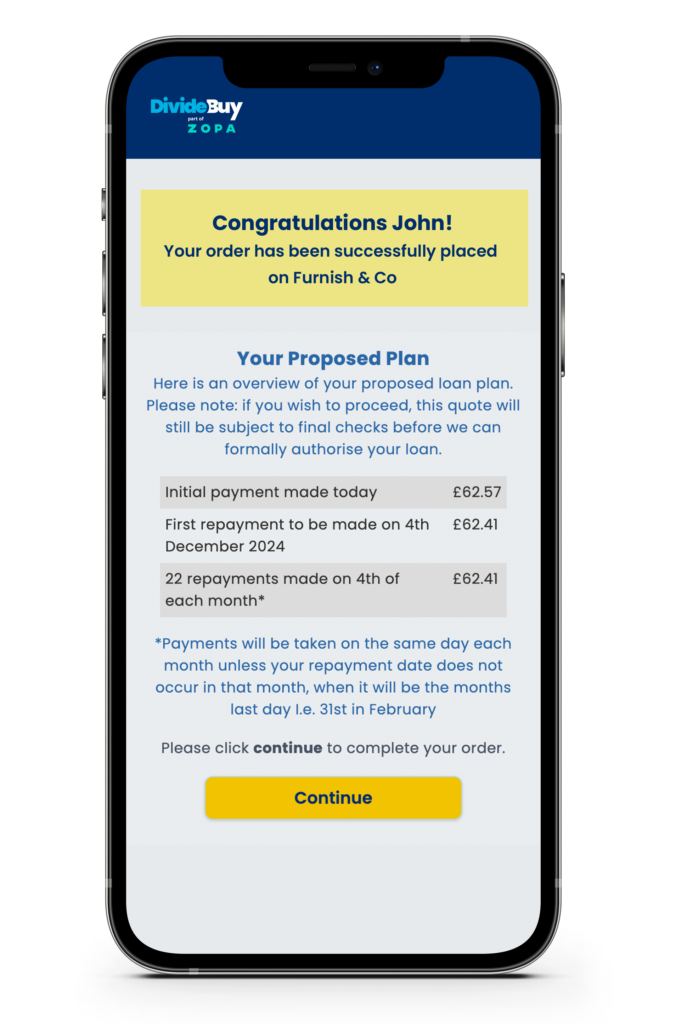

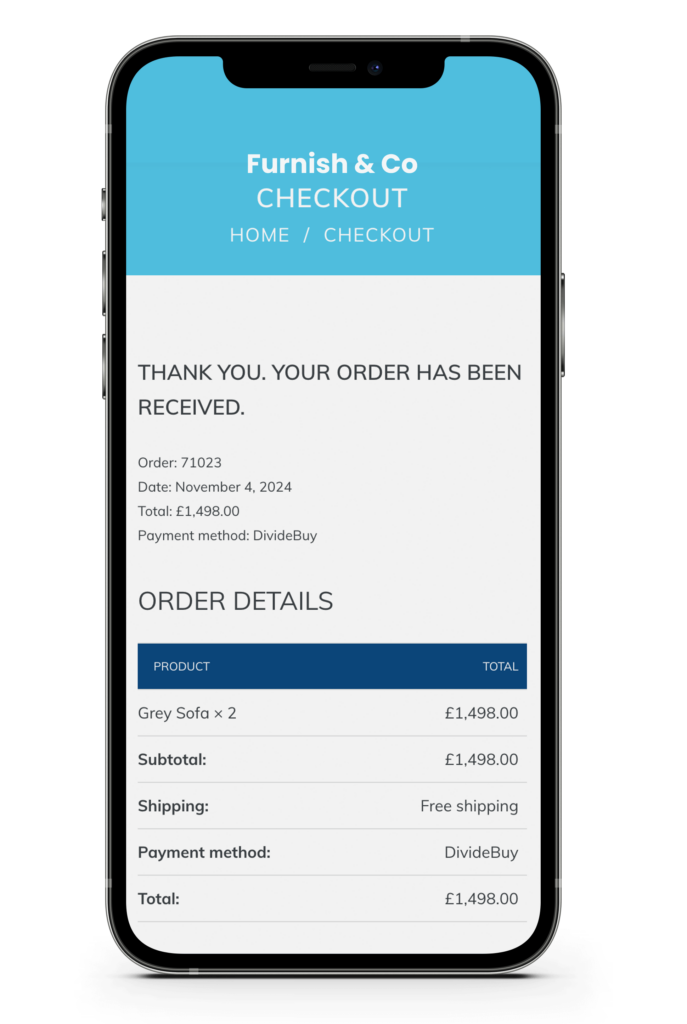

Retailers partner with interest free credit providers like Zopa to offer customers the option of spreading the cost of their purchase over several instalments with our retail finance solution, DivideBuy. The retailer receives the full payment from the interest free credit provider, while the customer pays the provider back in instalments over a set period.

This arrangement can be beneficial for retailers as it can increase sales, reduce cart abandonment, and improve customer loyalty.

Is there risk involved with interest free credit providers?

One potential downside of buy now pay later and interest free payments from the consumer’s side is that if they do not complete their purchase in full by the ”pay later date, they will need to make the minimum monthly repayment required, including interest.

Any missed payments may also result in a penalty charge from the credit provider.

How can interest free credit help my business?

Interest free credit is a great way to increase sales by making products more affordable and accessible to a wider range of customers. You can also use it to reduce cart abandonment rates, while increasing your average order value

By adding interest free finance options to your checkout you’ll help customers access the full range of your products more affordably – boosting loyalty and keeping them coming back for more.

Book a Demo

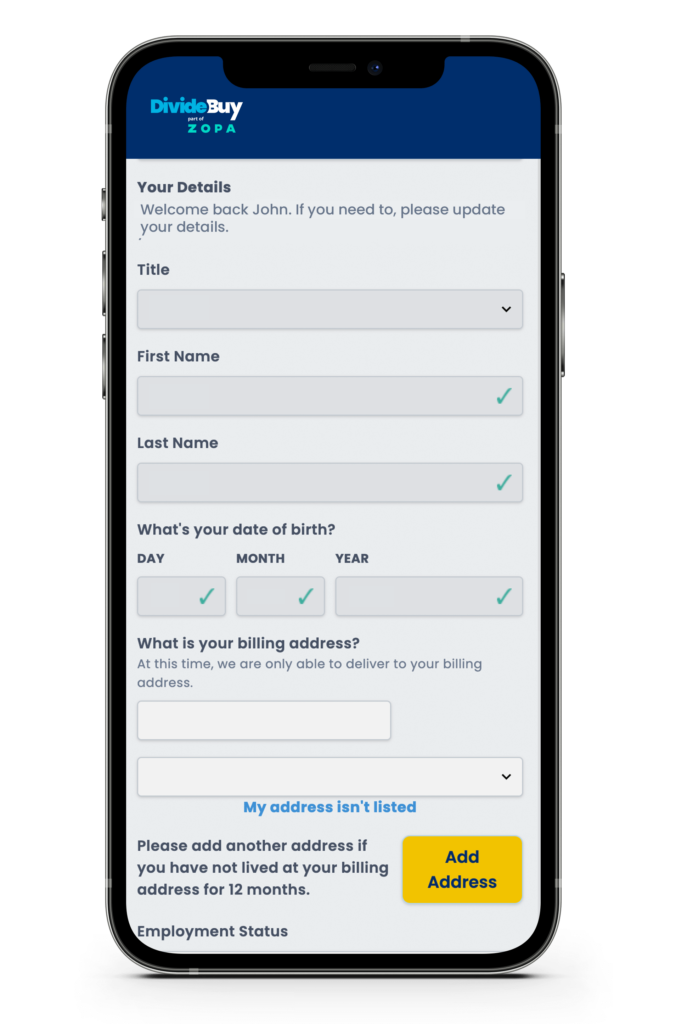

Our credit engine is so seamless, we can demo our solution in minutes. Experience our transformative customer journey in real-time and book a slot with our experts now.

What our merchants say

Read more about how we’re delivering results for merchants in your sector

How we drove a 71% conversion rate for Tech Sofa with tech-first retail finance solutions for success.

How we assembled AOV boosts of 73% for Cocoon with modular retail finance.

Helping customers spread the cost of levelling up by delivering high approval rates for students.

A Buyer’s Guide to Retail Finance

A Buyer’s Guide to Retail Finance