Types of finance we offer

Whether you’re new to finance or are looking for a change, our retail finance solutions can help you meet your goals, whether thats converting more browsers to buyers or increasing average order values.

How does Retail Finance work?

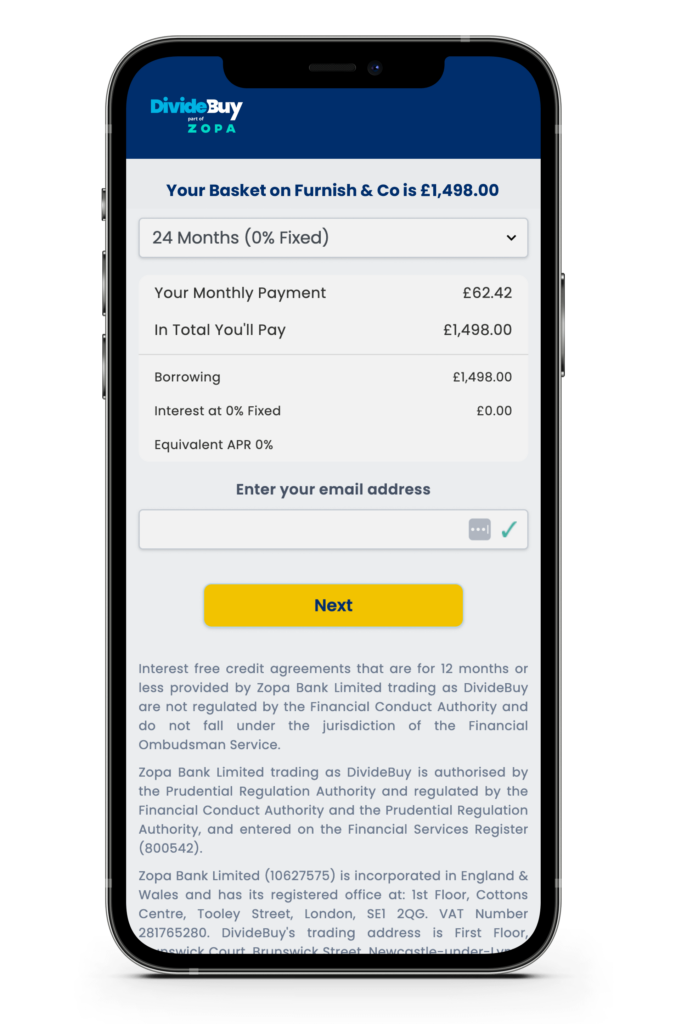

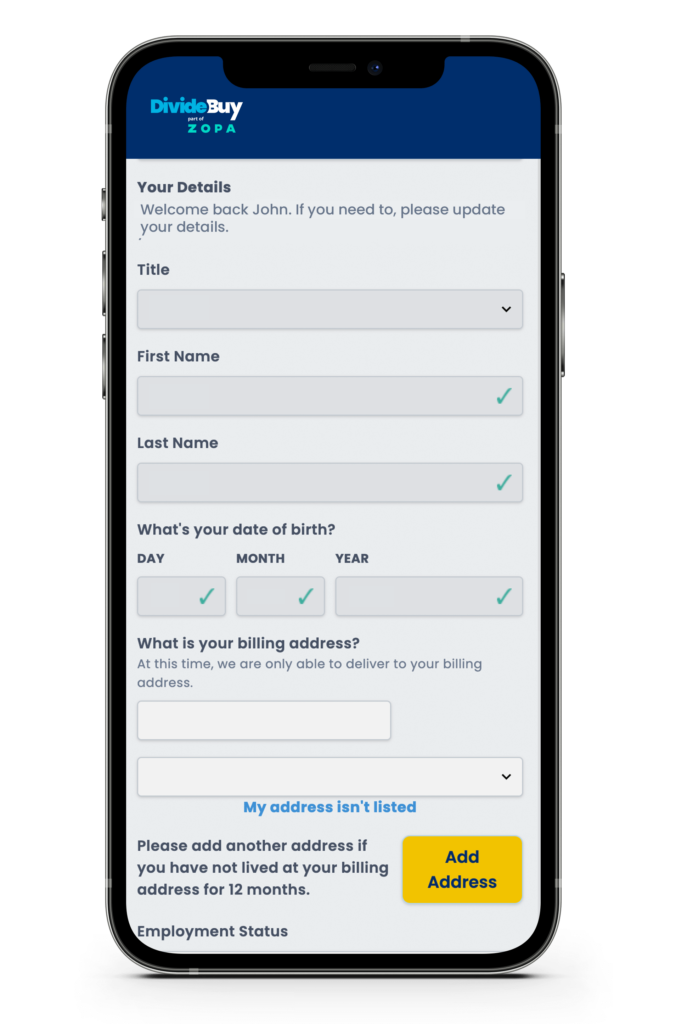

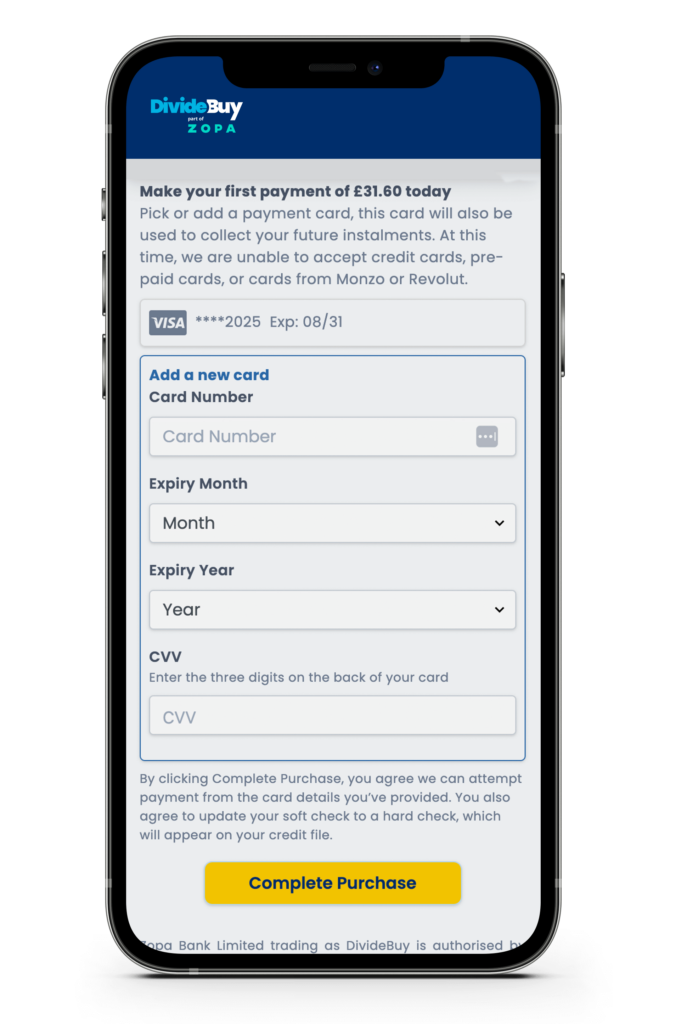

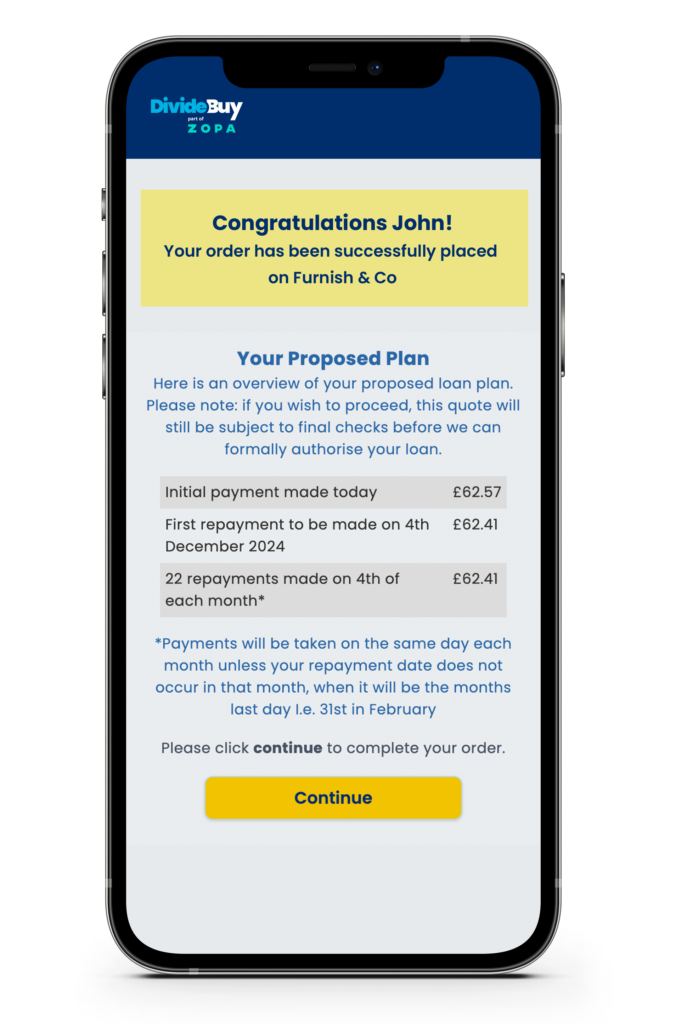

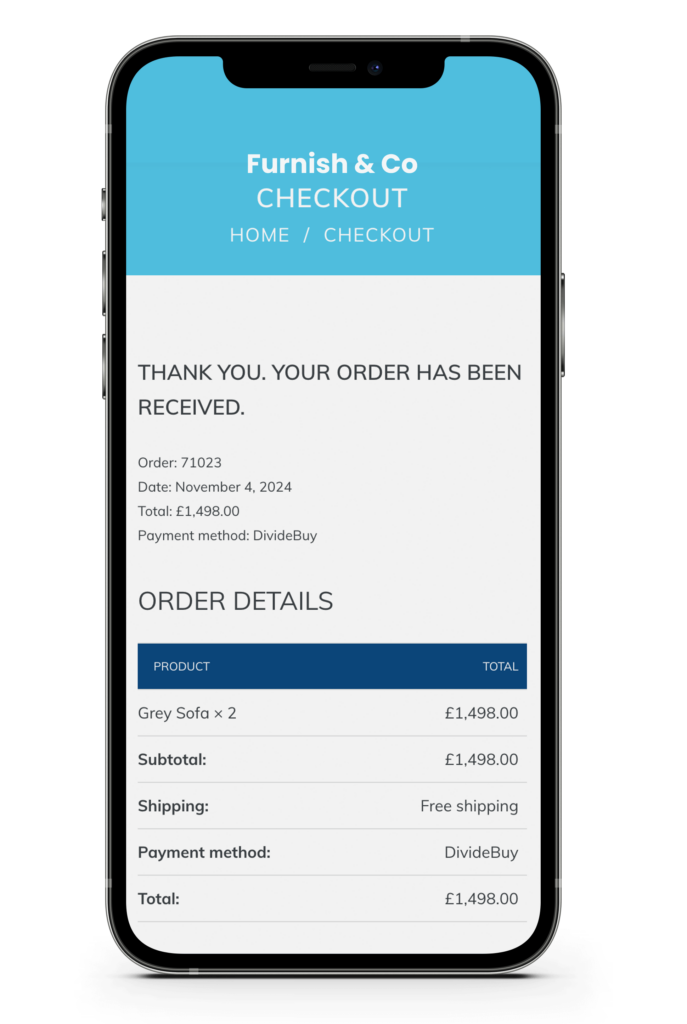

We provide both the technology and lending capabilities for your solution, meaning we handle every aspect of your integration. Whether its via a platform app, API or headless solution, we’ve got it all covered.

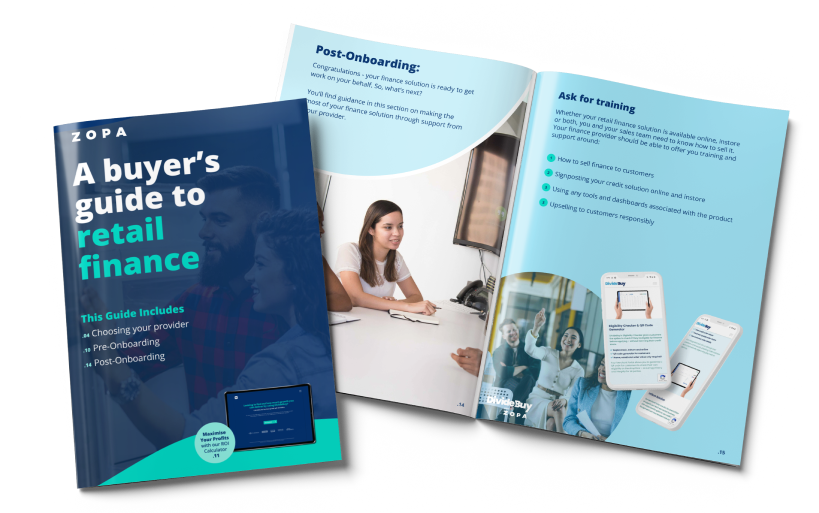

Offering checkout finance options is becoming a must-have for businesses online and instore. But how can you be sure which finance solution is the right fit for your business?

This guide and accompanying checklist will cover

Book a Demo

Our credit engine is so seamless, we can demo our solution in minutes. Experience our transformative customer journey in real-time and book a slot with our experts now.

What our merchants say

Read more about how we’re delivering results for merchants in your sector

How we helped Swyft increase revenue by 65% with A/B testing for optimised credit sales.

Helping MuscleSquad drive a 545% basket value increase with flexible retail finance.

How we drove a 71% conversion rate for Tech Sofa with tech-first retail finance solutions for success.

Try our Approval Calculator

Try our Approval Calculator