e-Careers: Skilled Solutions

Helping customers spread the cost of levelling up by delivering high approval rates for students.

Our partnership with DivideBuy provides opportunities for even more people to better their careers and improve their prospects. We’ve found their team and services to be knowledgeable and informative, very easy to work with, and always around to help. I’m delighted to report that the partnership is helping us with one of our key goals – to address the UK’s skills gap.

Varun Bhatt, CEO, e-Careers

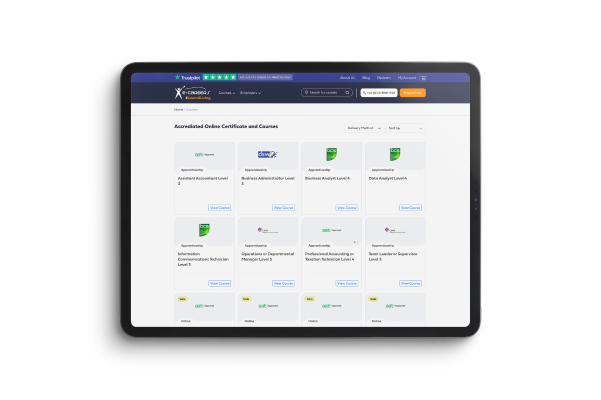

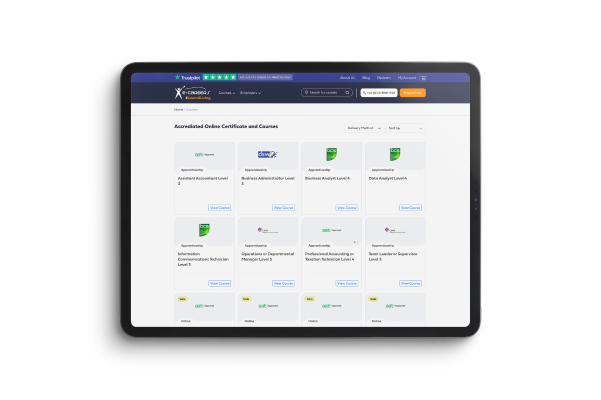

Founded in 2011, e-Careers’ online and in-person training solutions align with globally-recognised accreditations to help fill skills gaps and empower talent to succeed.

The company’s innovative model is transforming the world of virtual learning, forming strategic partnerships with leading F.E colleges and trade unions. To date, they’ve trained over 615,000 individuals across a wide range of skills verticals – from accounting to football – and have placed over 4,000 people directly into employment.

e-Careers had worked with another consumer finance provider previously. However, it experienced some issues with the lender’s performance. These were major barriers to growth, not only due to impact on revenue, but also due to potential damage in relationships with students.

e-Careers core ethos revolves around improving access to quality training and upskilling. But its previous finance solution was presenting some challenges.

DivideBuy proposed an interest free credit solution that allowed e-Careers to attract a wider variety of customers. Flexible and affordable payment options meant e-Careers could offer more extensive, higher-priced courses to students.

With options to spread the repayments over 12 months, plus a soft check option when applying for credit, e-Career’s goal of improving access to finance was met.

Our credit engine is so seamless, we can demo our solution in minutes. Experience our transformative customer journey in real-time and book a slot with our experts now.

Read more about how we’re delivering results for merchants in your sector

How we helped Sofa Club increase conversion rates by 40% with flexible finance solutions.

Squaring 422% of annual sales targets with flexible retail finance solutions.

How we drove a 29% conversion increase for Nectar thanks to retail finance.