Deferred payment plans with custom integration

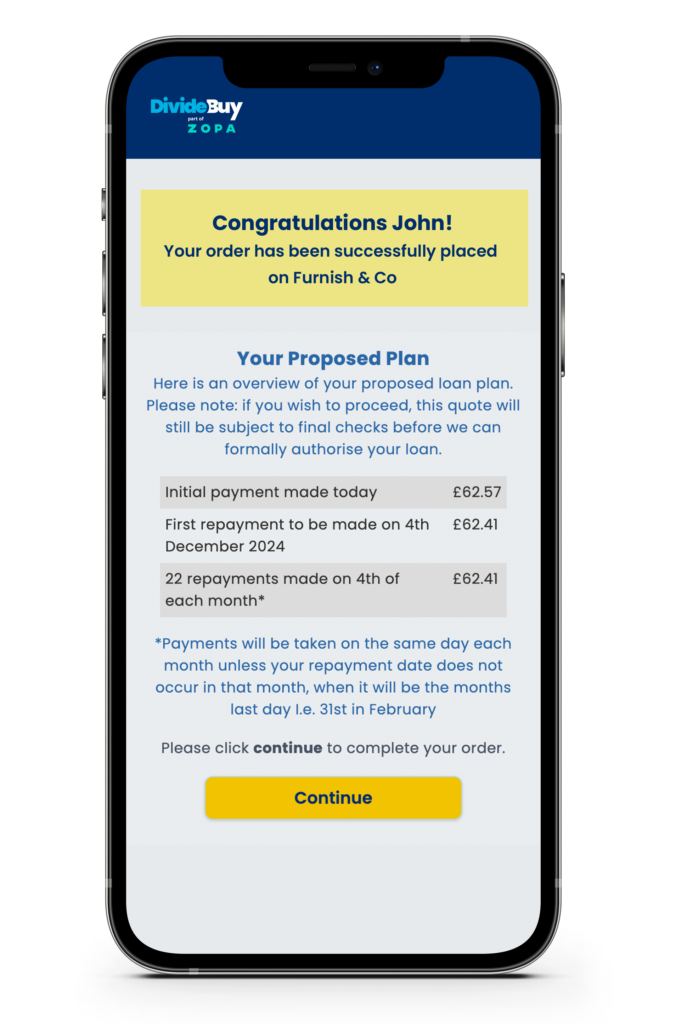

Our bespoke Retail Finance solution consists of a Headless API that supports panel lending. Own the initial stages of your front-end finance journey and let customers access offers from multiple lenders, all in one simple application.

There are benefits for sellers, too. Because we provide bespoke Retail Finance solutions ourselves, not through a third party, we can accept around 33% more customers than other credit providers. As a result, retail partners who integrate our bespoke Retail Finance solution typically see a 70% increase in sales conversions and lower rates of basket abandonment.

How does Retail Finance work?

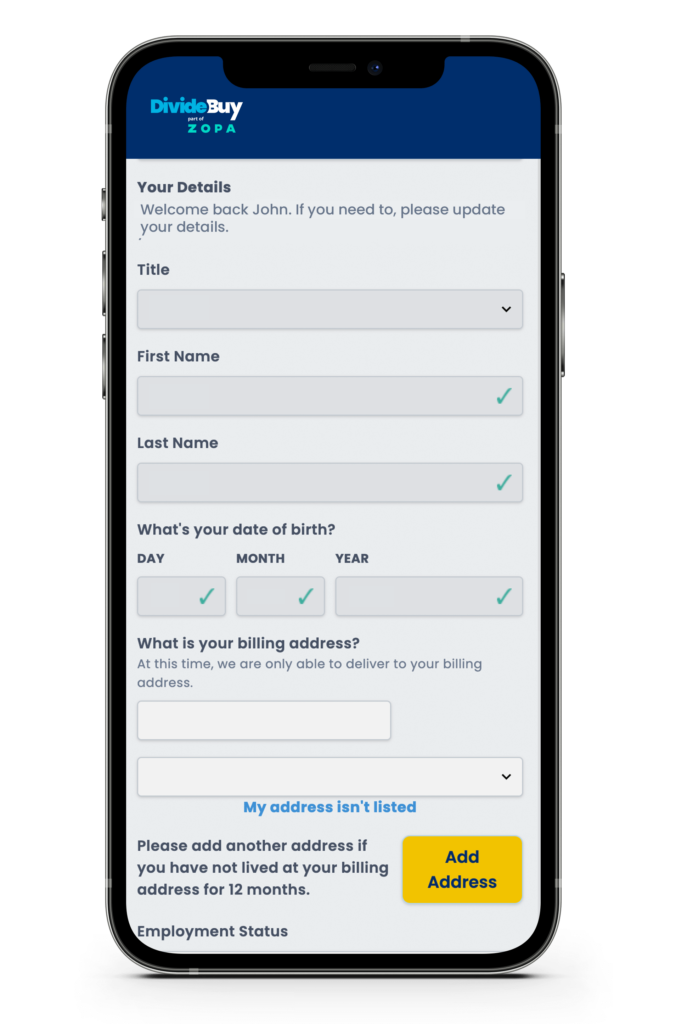

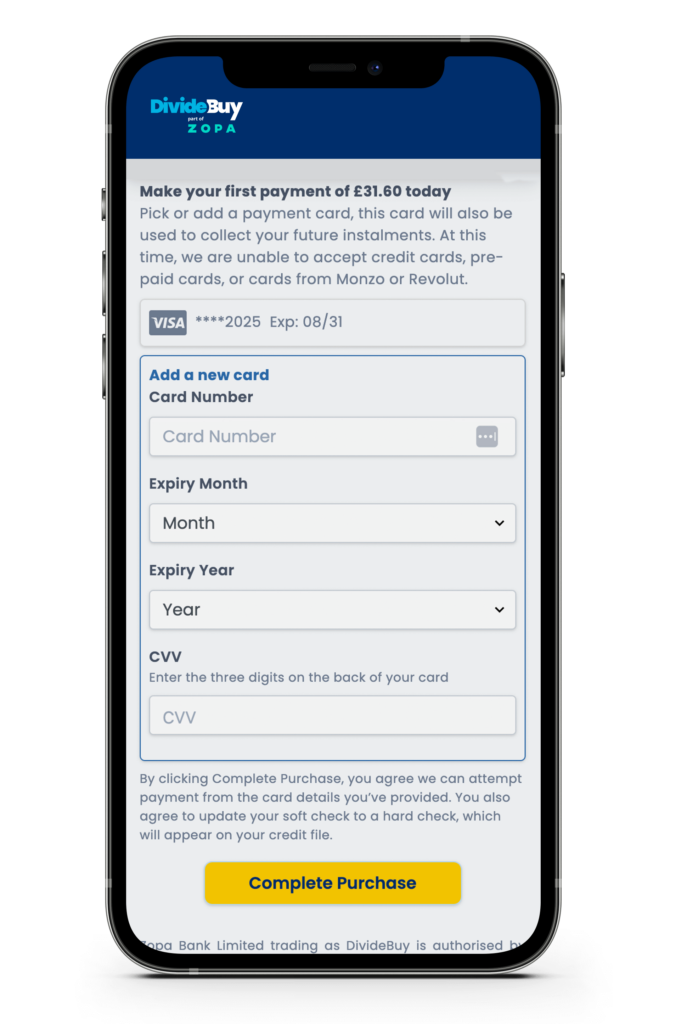

We provide both the technology and lending capabilities for your solution, meaning we handle every aspect of your integration. Whether its via a platform app, API or headless solution, we’ve got it all covered.

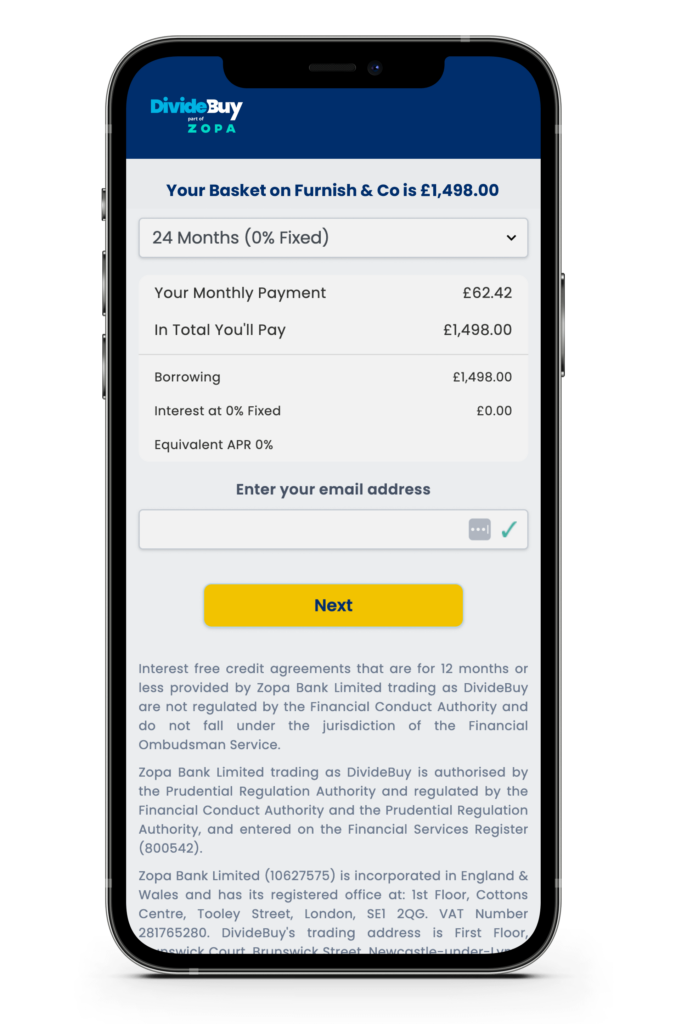

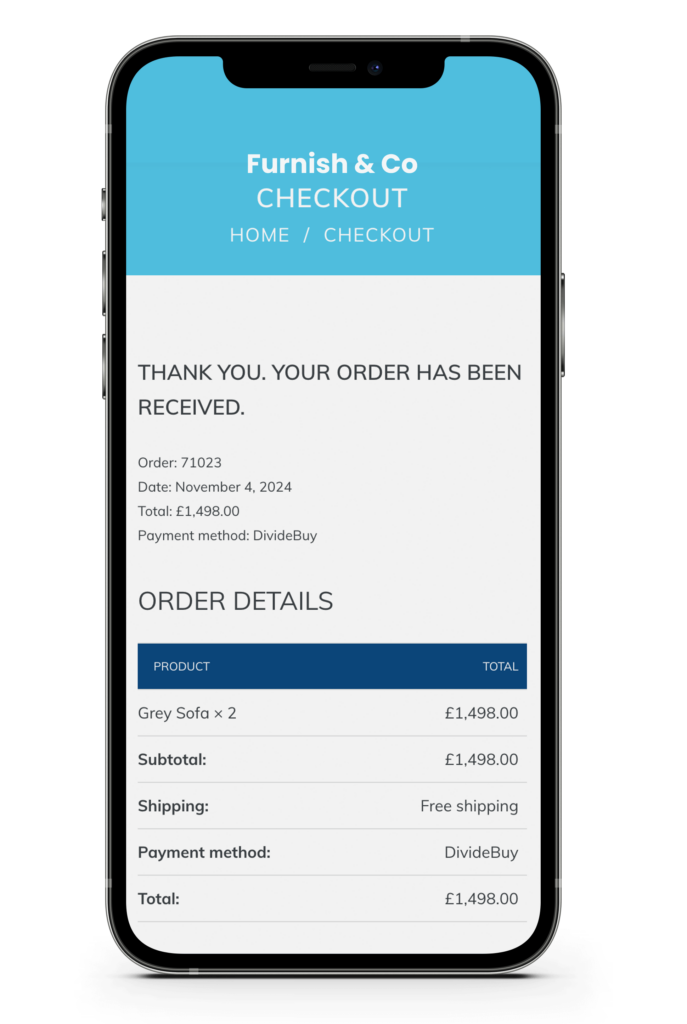

Offer pay in instalments online

Offering your customers the ability to pay in instalments is an excellent option for businesses looking to increase their sales, improve customer loyalty, and attract new customers who are looking for a more convenient way to pay for their purchases.

If your eCommerce platform is unique, it’s not a problem. We offer bespoke integration support to help your customers enjoy interest free and interest bearing finance instalment plans when they shop online. To find out more, check out our guide to your bespoke installation below.

Bespoke finance plugins for your eCommerce website

We can handle your bespoke retail finance integration for you, or if your own Development Team wishes to install it, you can download our handy guide.

Integrating a finance extension with your online store allows you to provide a payment plan option as part of the eCommerce checkout process. Using a finance plugin increases your conversion rates and turnover by offering a custom, flexible payment plan option to customers.

DivideBuy’s innovate technology aligns with our own, allowing our customers to access high-quality care quickly and easily, regardless of where they find us. We’re confident that DivideBuy is the right finance partner to meet our needs as we continue to evolve and grow.

Dr. Stewart Halperin, Founder, Stem Cell Vets

Book a Demo

Our credit engine is so seamless, we can demo our solution in minutes. Experience our transformative customer journey in real-time and book a slot with our experts now.

What our merchants say

Read more about how we’re delivering results for merchants in your sector

Unleashing a sales increase of 92% with flexible retail finance solutions.

Our retail finance solution delivered barking mad approvals and conversions.

Helping customers spread the cost of levelling up by delivering high approval rates for students.