What is buy now pay later?

Buy now pay later is a shopping cart plugin payment option that enables customers to delay paying for a product or service for an agreed period of time – hence the name ‘buy now, pay later’.

If you want to offer customers the option to spread the cost of a smaller purchase for up to 6 months, this could be a great way to increase sales and boost basket value.

How does Retail Finance work?

We provide both the technology and lending capabilities for your solution, meaning we handle every aspect of your integration. Whether its via a platform app, API or headless solution, we’ve got it all covered.

More sales, less risk

Our robust, holistic approach and unique credit decision engine enables us to accept more customers than other pay later solutions.

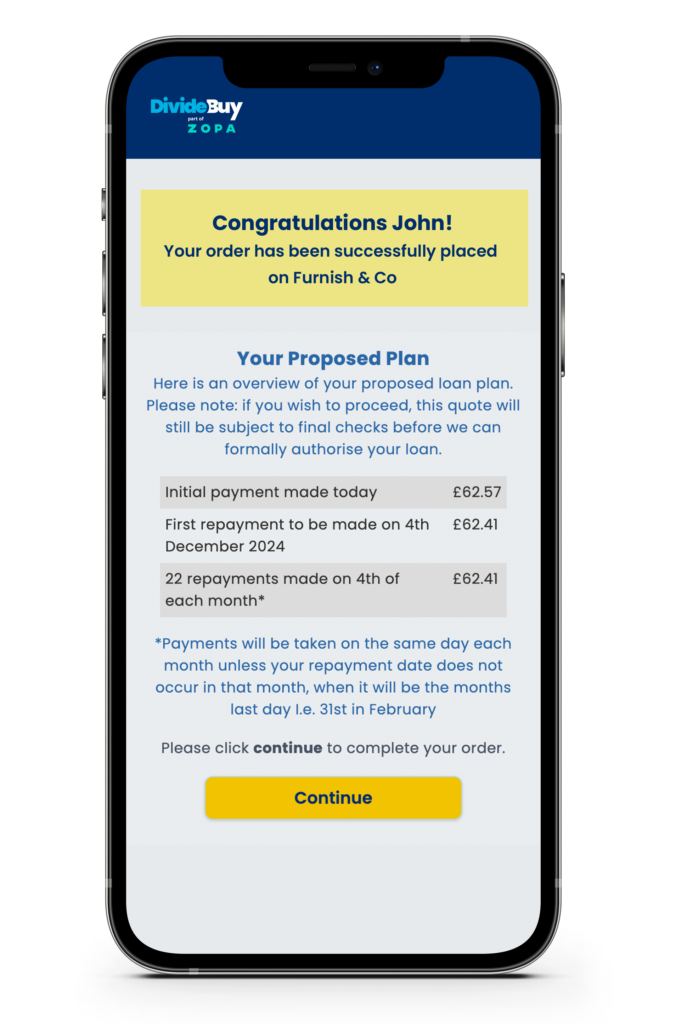

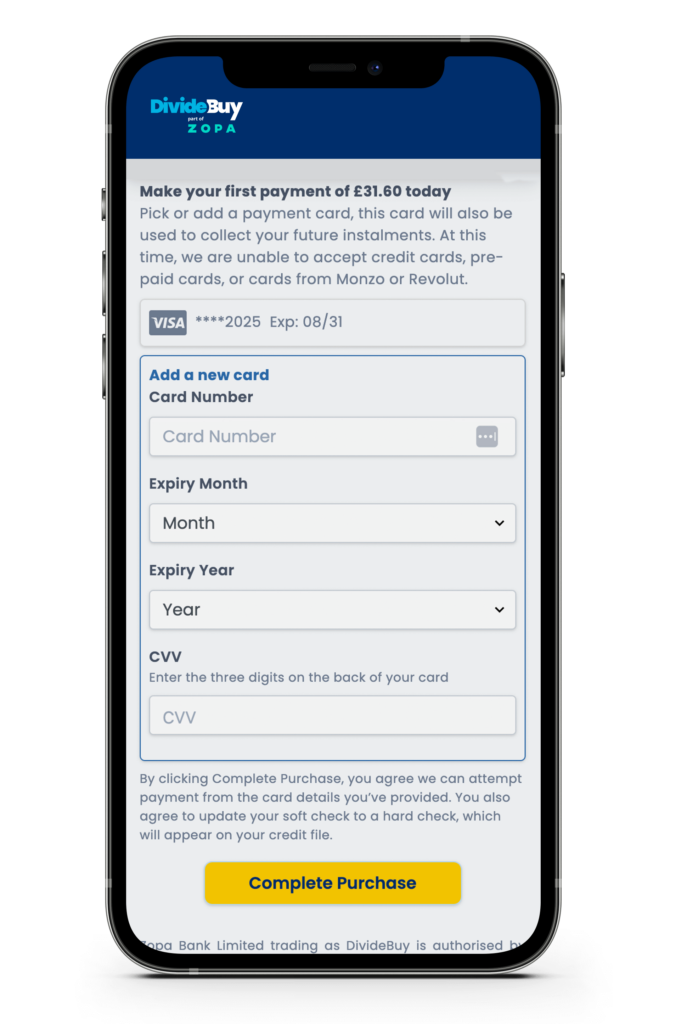

As a fully regulated lender, we’ve modelled our short and longer term finance journeys to follow the guidance of the Financial Conduct Authority – so you, your business and your customers are in good hands.

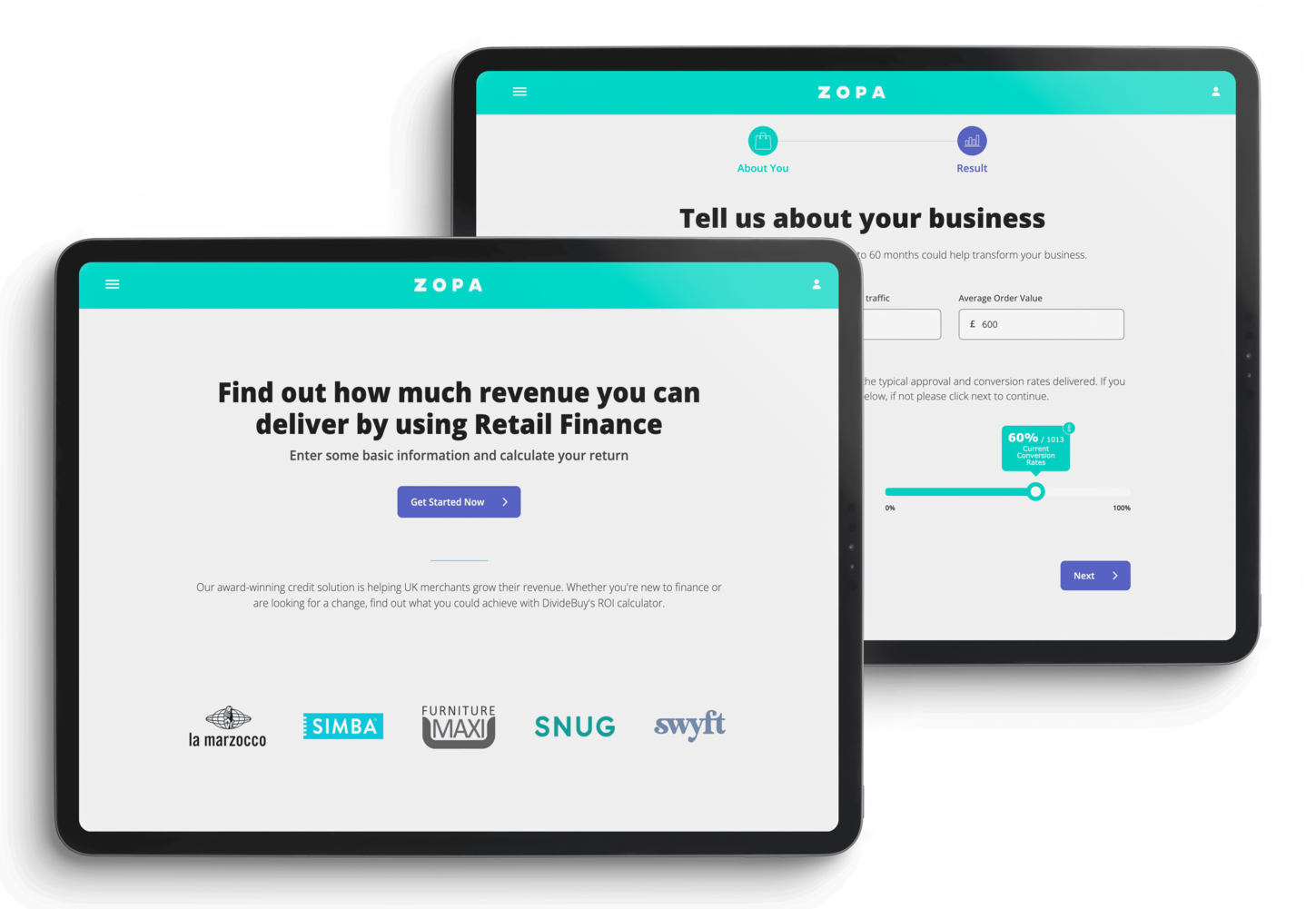

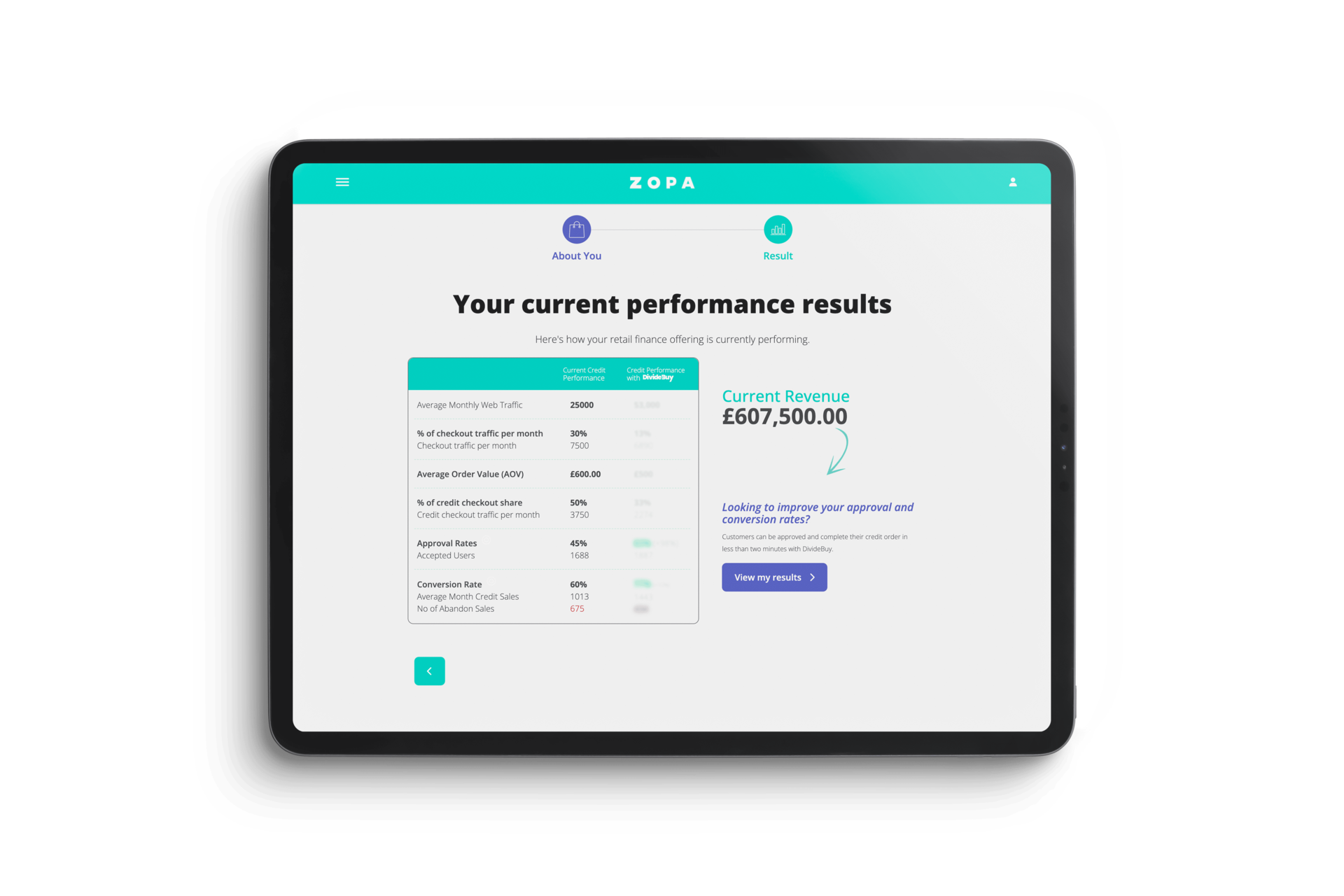

Our award-winning retail finance solution is helping UK merchants boost their revenue. Whether you’re new to finance or are looking for a change, find out what you could achieve with our Approval Calculator.

What are the risks of using buy now pay later?

When used correctly, buy now pay later is an excellent way to fund short-term, small-ticket purchases and even helps build up credit scores. However, some providers are not clear enough about the risks associated with failing to make a payment on time, or missing one entirely.

We are regulated by the Financial Conduct Authority and ensure that all of our finance journeys mirror guidance which keeps you, your business and your customers safe.

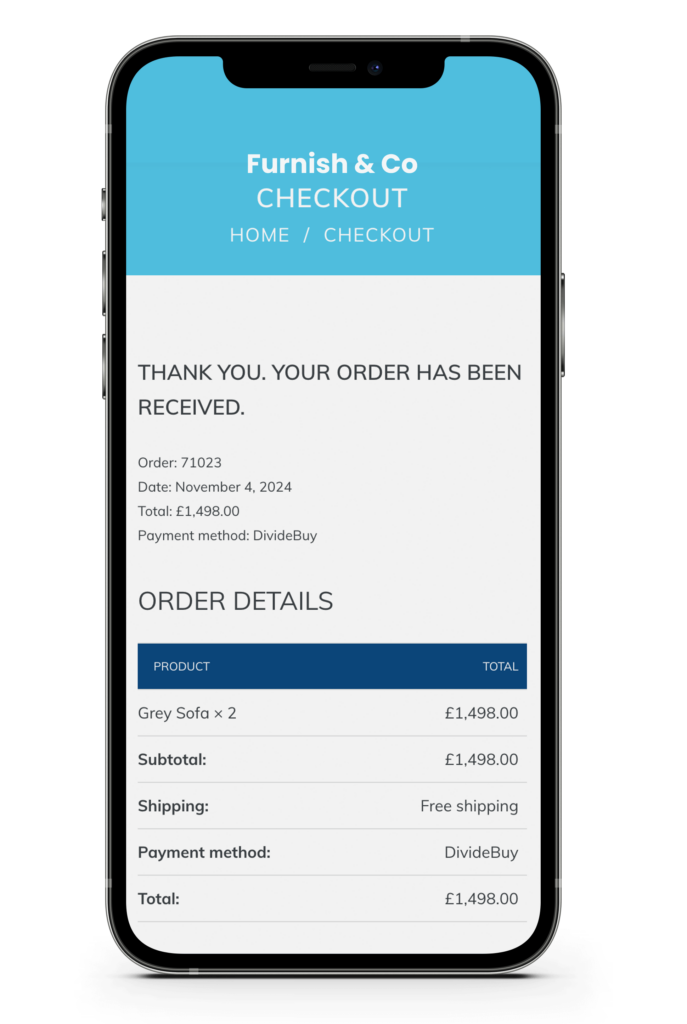

How does BNPL work for businesses?

Merchants using our buy now pay later solutions benefit from increases sales, boosted average order value and a competitive edge.

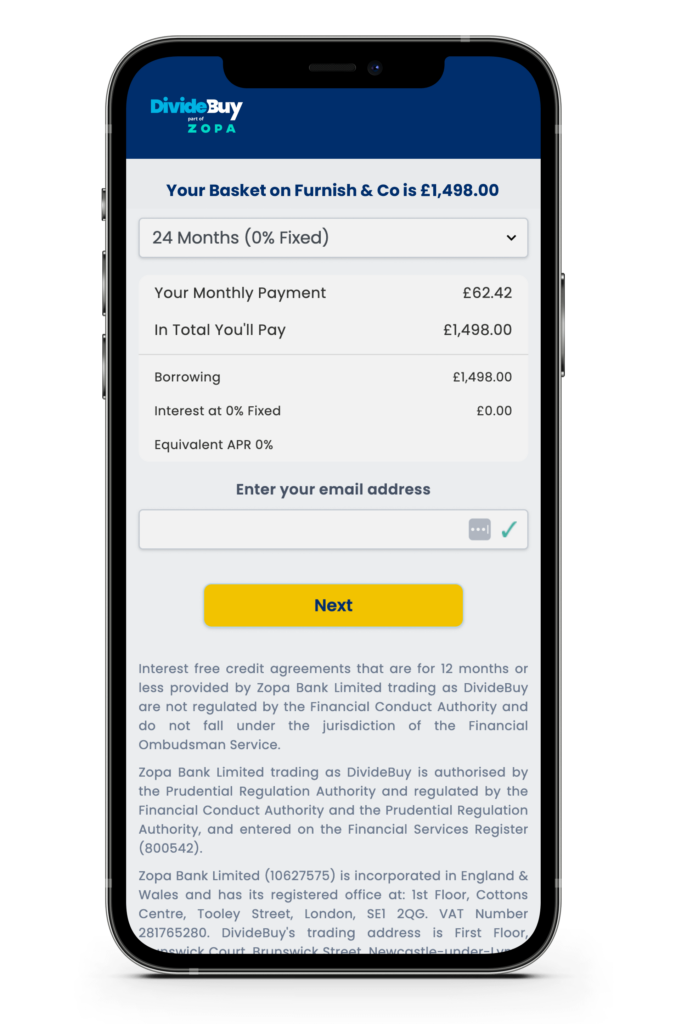

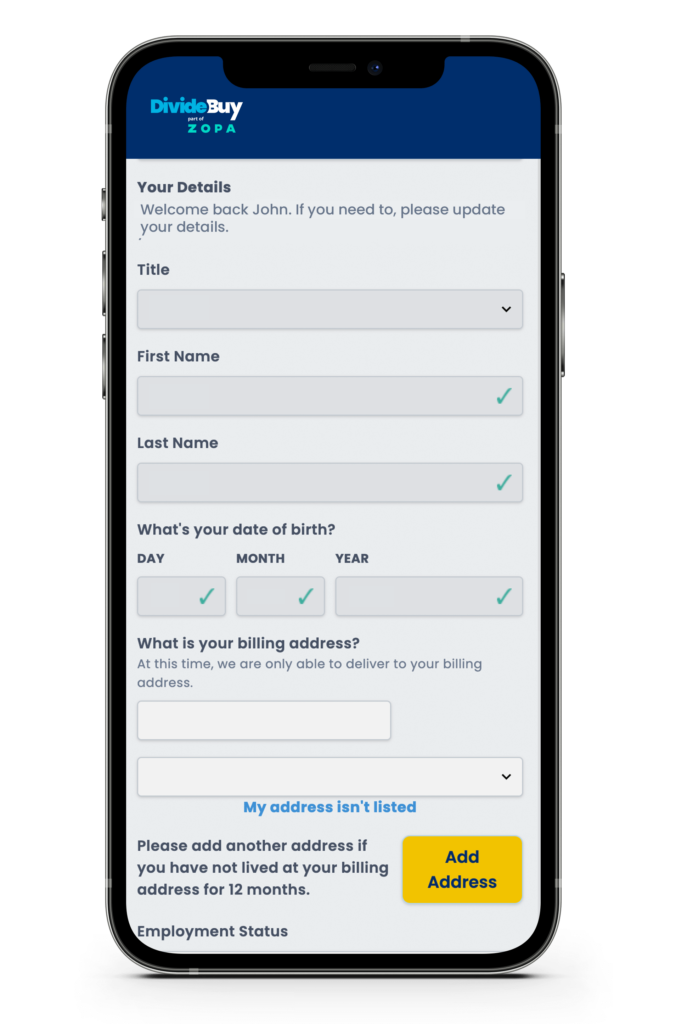

As your finance provider, we’ll deliver a seamless application journey for your customers. Once they’re approved for finance and have their order delivered, we’ll pay you in full for the purchase, then handle collecting the instalments.

How can Buy Now Pay Later help my business?

Our buy now pay later solutions are helping merchants across a wide range of sectors, from furniture to healthcare.

Thanks to our track record of delivering high approval and conversion rates, merchant using our buy now pay later solutions have seen strong growth outcomes.

Book a Demo

Our credit engine is so seamless, we can demo our solution in minutes. Experience our transformative customer journey in real-time and book a slot with our experts now.

What our merchants say

Read more about how we’re delivering results for merchants in your sector

How we helped Swyft increase revenue by 65% with A/B testing for optimised credit sales.

Simply Baby increased sales, boosted credit approvals and turned more browsers into buyers with Zopa.

Helping MuscleSquad drive a 545% basket value increase with flexible retail finance.

A buyer’s guide to Retail Finance

A buyer’s guide to Retail Finance