Simba: The lie-in king

We increased sales by 25% for Simba Sleep thanks to our retail finance solutions.

DivideBuy has a proven success with conversions, so we were convinced that its offerings could solve the checkout problems we were experiencing and lead to a better ROI.

I would absolutely recommend DivideBuy to other businesses looking to implement an interest-free credit solution. DivideBuy will work directly with you to tailor a journey that works to your business’ needs, like it worked with us to create a solution that helped us hit our KPIs.

Jon Moore, Head of eCommerce, Simba

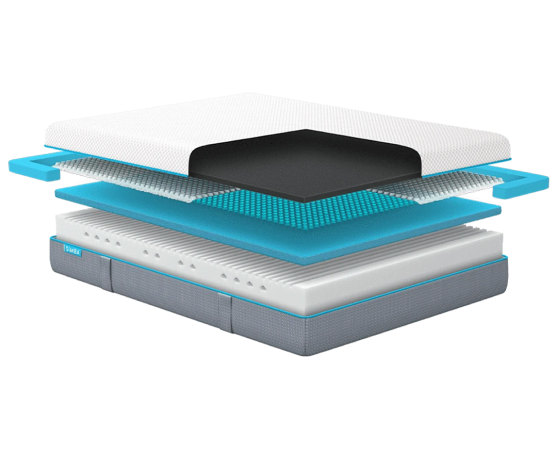

Simba Sleep, a leading technology brand, started in the mattress industry in 1979, supplying the thread that went on to be used in over 50 million mattresses in over 35 countries.

In 2002, Simba diversified into mattress design and supply, setting out to create the ultimate mattress that would trump all others. Consumers quickly jumped into bed with the Simba mattress, drawn in by the quality of the product.

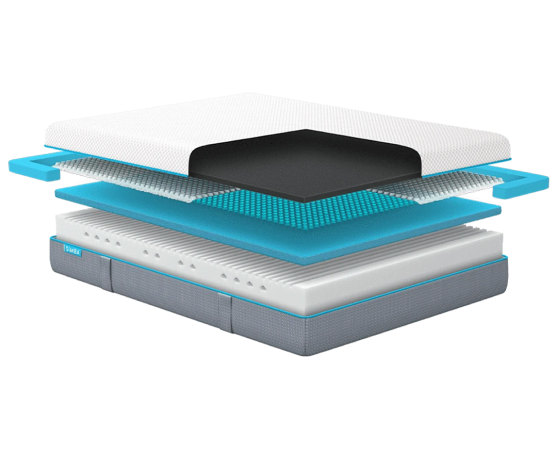

However, many could not afford to make a one-off payment, as mattresses ranged between £500 to £1000.

Simba was using an interest-free, instalment-based, payment provider. This seemed straightforward enough.

But over time, issues began to arise with the finance provider’s performance that were concerning for Simba.

Zopa achieved this increase by improving the customer conversion rate through addresses many of the UX challenges.

Its quick and simple sign-up process worked to the customers benefit by retaining interest in the sale, and Zopa’s high rate of acceptance meant that more customers were able to take advantage of instalment-based payments.

Our credit engine is so seamless, we can demo our solution in minutes. Experience our transformative customer journey in real-time and book a slot with our experts now.

Read more about how we’re delivering results for merchants in your sector

There was no lounging about on sales for Furniture Maxi with our retail finance solutions.

How we drove a 70% conversion rate for OTTY with retail finance.

How we drove a 29% conversion increase for Nectar thanks to retail finance.