Charles & Ivy: All decked out

Charles & Ivy increased average order and conversions thanks to 82% approval rates with retail finance.

Charles & Ivy began with a simple observation: conventional fencing and screening is unremarkable, dull and maintenance-heavy. The same applies to finance provision with long application processes and poor user journeys that make customers walk away. DivideBuy’s agile finance solution caters perfectly to our customers’ needs and appetite. We’re glad to partner with them on our mission to make high-end products affordable.

Alexander Dobson, Head of Commerce, Charles & Ivy

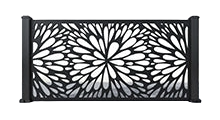

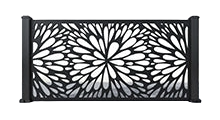

Charles & Ivy have made it their mission to create a stylish, durable, low-maintenance modular fencing system that enables people to transform and personalize their gardens.

As their range of superior products took the market by storm, their offer has evolved to products that elevate interior spaces as well. The company wanted to offer retail finance so customers could access their full range of products in an affordable way.

The company wanted to offer retail finance so customers could access their full range of products in an affordable way.

Having never offered credit in the past, Charles & Ivy began their search for a provider, when they encountered some concerns.

Charles & Ivy settled on Zopa’s retail finance solution, DivideBuy, to offer retail finance to customers.

DivideBuy acted quickly to meet the needs of customers based on feedback, offering Charles & Ivy a seamless finance solution which yielded strong results.

Our credit engine is so seamless, we can demo our solution in minutes. Experience our transformative customer journey in real-time and book a slot with our experts now.

Read more about how we’re delivering results for merchants in your sector

Lawn-term lending boosts revenue by 30% for Grass Warehouse thanks to flexible retail finance.

There was no lounging about on sales for Furniture Maxi with our retail finance solutions.

AMC got in bed with Zopa to provide their customers with alternative and instant ways to spread the cost.