Nectar: Sweet dreams

How we drove a 29% conversion increase for Nectar thanks to retail finance.

We partnered with DivideBuy to help increase our conversion rates, while offering our customers a better credit experience. Our conversion rates are now up by 29%, and we’re glad to have DivideBuy supporting us in our next stages of growth.

Nectar, UK

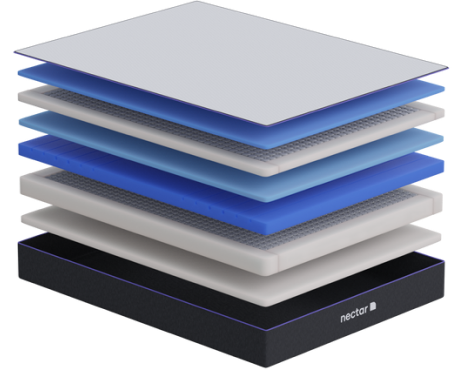

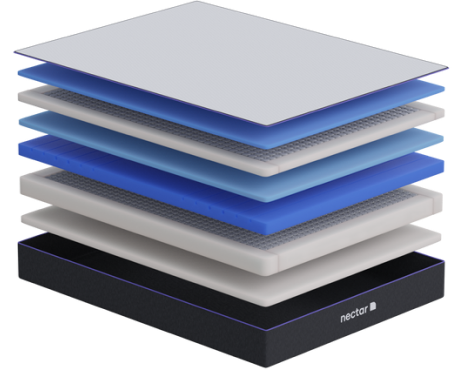

Launched in the United States in 2016, Nectar is one of the world’s fastest growing direct-to-consumer sleep product companies.

Since launching in the UK in 2018, Nectar has already achieved impressive growth thanks to its unique 365-night mattress trial and forever warranty. British made and produced, Nectar Sleep is also the UK’s only 100% climate neutral ‘bed in a box’ mattress.

Nectar had built a strong brand overseas and was keen to maintain its stellar reputation in the UK.

It was also looking to boost growth through increased conversion rates across its eCommerce site. However, it began to experience issues with its chosen POS finance provider.

The brand decided it was time to look at an alternative finance provider who could deliver growth and an exceptional customer experience – and decided on DivideBuy .

After just one year with DivideBuy, Nectar found its credit performance significantly improved. Divide Buy’s agile technology, combined with its highly-rated customer service approach and flexible lending capacity made it the perfect fit for Nectar.

Our credit engine is so seamless, we can demo our solution in minutes. Experience our transformative customer journey in real-time and book a slot with our experts now.

Read more about how we’re delivering results for merchants in your sector

We increased sales by 25% for Simba Sleep thanks to our retail finance solutions.

How we drove a 70% conversion rate for OTTY with retail finance.

Delivering a dreamy average order value boost of 54% with retail finance solutions.