GolfBays: Swinging sales

Squaring 422% of annual sales targets with flexible retail finance solutions.

Our products are loved and used by a wide range of customers, from businesses and leisure centres to golf-lovers at home. Bringing our love of the sport to as many people as possible, whilst growing our sales, was key to our search for longer-term finance. Zopa’s retail finance solution, DivideBuy, is the perfect fit for our needs.

Oliver Baddeley, Sales and Operations Manager, GolfBays UK

Now a leading provider of outdoor and indoor golf enclosure and simulator experiences, GolfBays UK began its journey when Rob, its golf-loving founder, looked for ways to beat the elements.

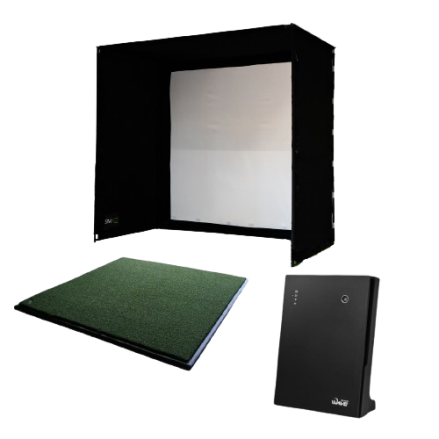

Today, the company’s mainstay products are its superb range of robust, easy-to-assemble, conveniently sized, steel frame canvas enclosures. Its simulator bundles are internationally acclaimed, and in a few short years, GolfBays UK has grown exponentially.

As its product range expanded, the business looked at ways to increase conversion rates through point of sale finance.

Initially, it partnered with PayPal, but was looking for a provider who could service its higher-ticket items and offer longer repayment options for greater customer choice.

Zopa’s retail finance solution, DivideBuy, offered a comprehensive suite of finance tools. Its interest free and interest bearing credit options from 3-60 months let customers access GolfBay UK’s impressive range of products more affordably.

Thanks to a sub-2-minute customer journey and conversion-boosting tools like DivideBuy’s Eligibility Checker, it didn’t take long for the business to see results.

Our credit engine is so seamless, we can demo our solution in minutes. Experience our transformative customer journey in real-time and book a slot with our experts now.

Read more about how we’re delivering results for merchants in your sector

Helping MuscleSquad drive a 545% basket value increase with flexible retail finance.

We helped Jam Golf putt a swing in its sales with longer-term retail finance.

Spinning the wheels of success for Pearson with retail finance that boost conversions.