What is interest bearing credit?

With interest bearing credit, customers can spread the cost of a purchase over longer periods of time, with an additional charge on top. This amount (interest) is usually fixed, and saves merchants having to pay for the cost of credit themselves.

Interest bearing credit works well for products with smaller profit margins, or for high-ticket items that require longer instalment periods.

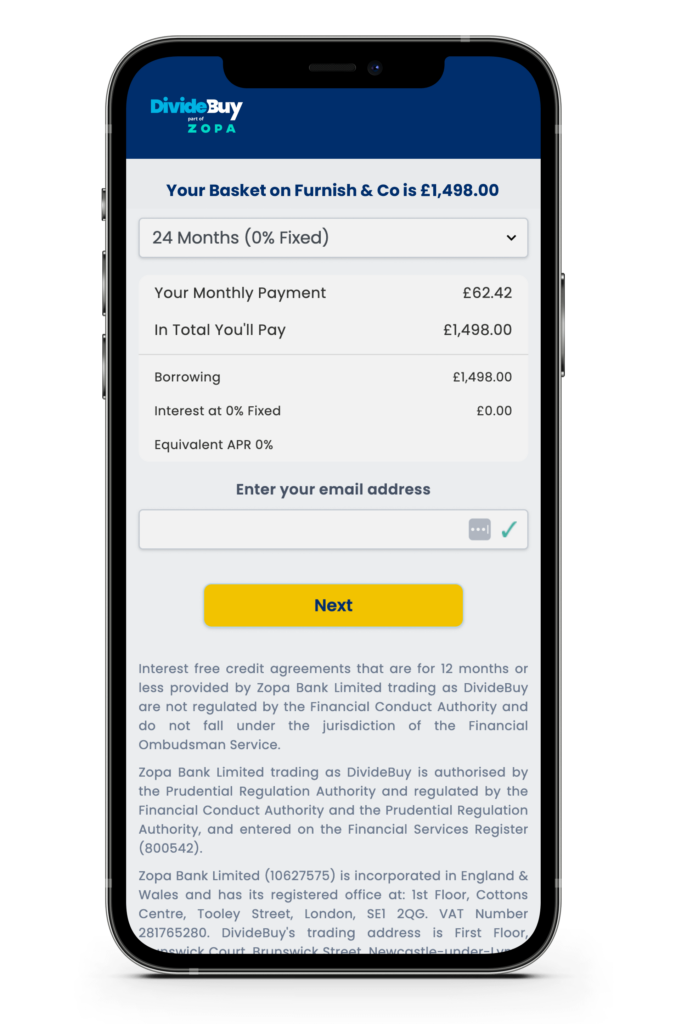

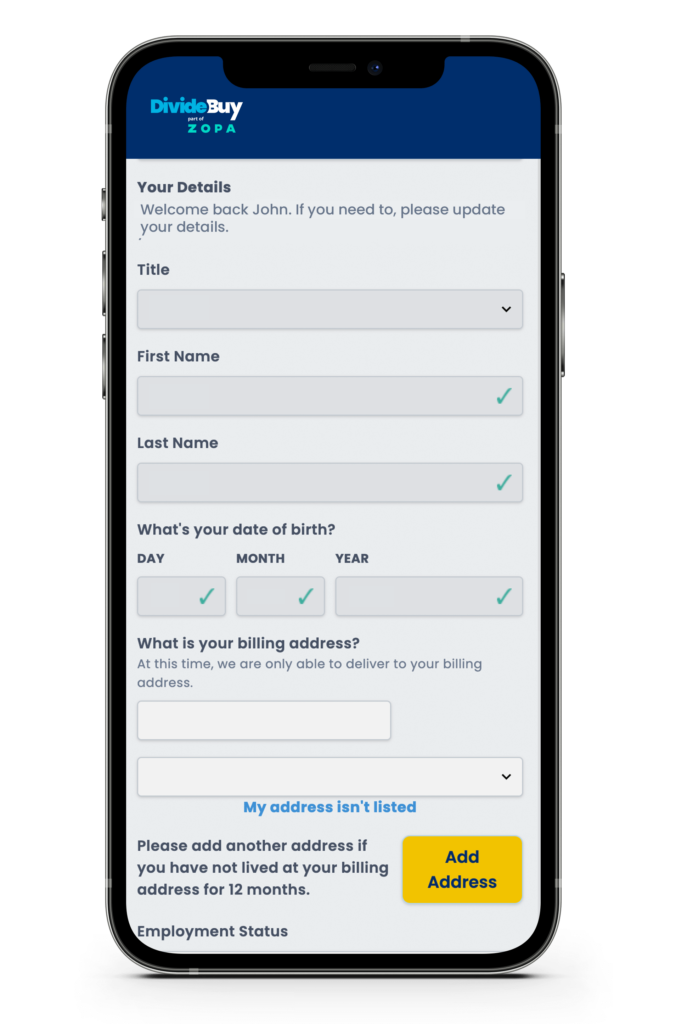

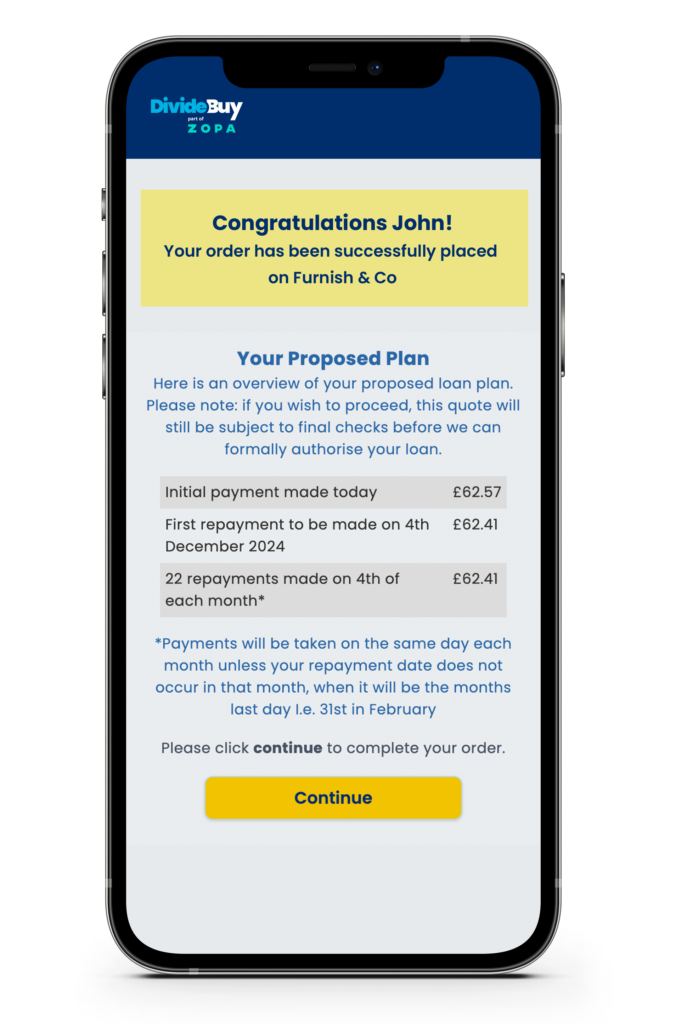

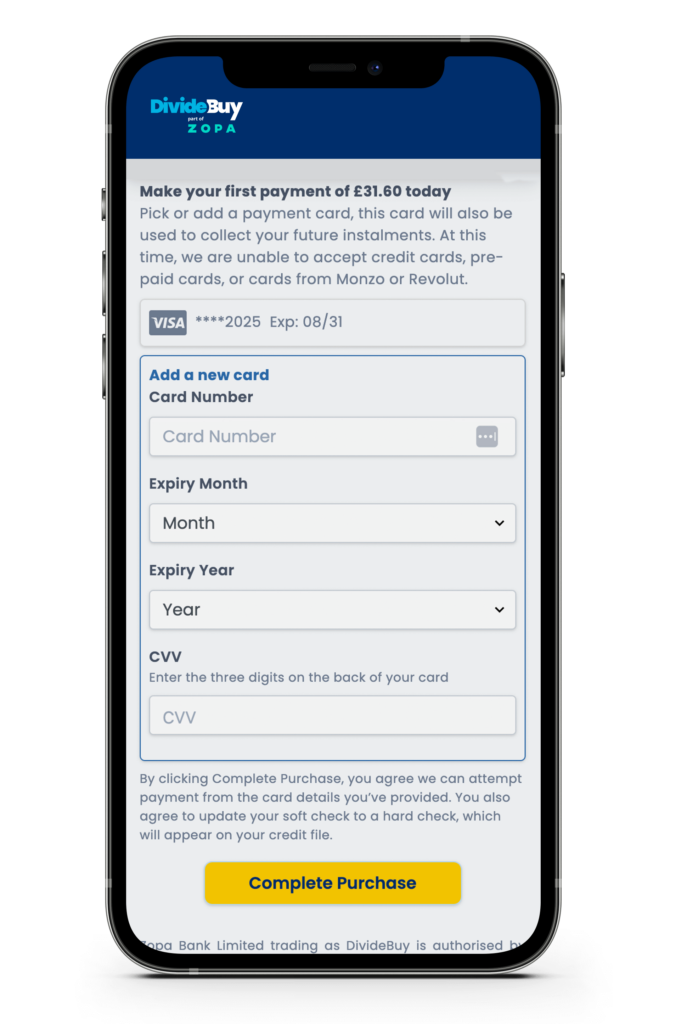

How does Retail Finance work?

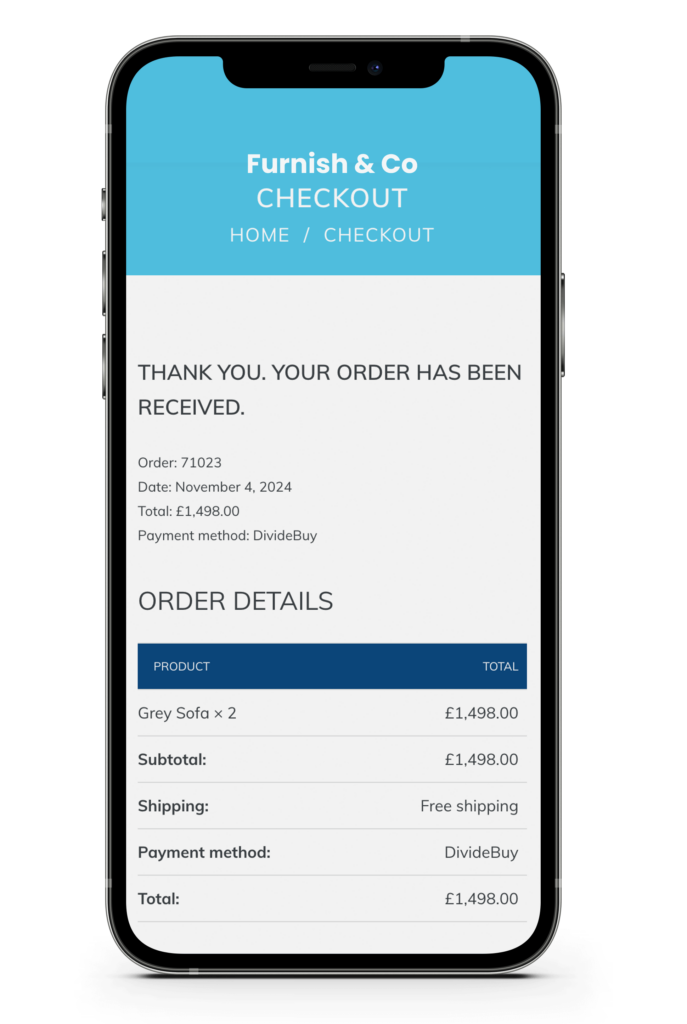

We provide both the technology and lending capabilities for your solution, meaning we handle every aspect of your integration. Whether its via a platform app, API or headless solution, we’ve got it all covered.

More sales, less risk

Our interest bearing finance options are fully regulated by the Financial Conduct Authority, ensuring customers can access credit safely and affordably.

Unlike other providers, we don’t charge late fees or additional interest as a result of missed or delayed payments. Our robust lending engine and decisioning framework also means we can responsibly approve a higher percent of your customers for credit.

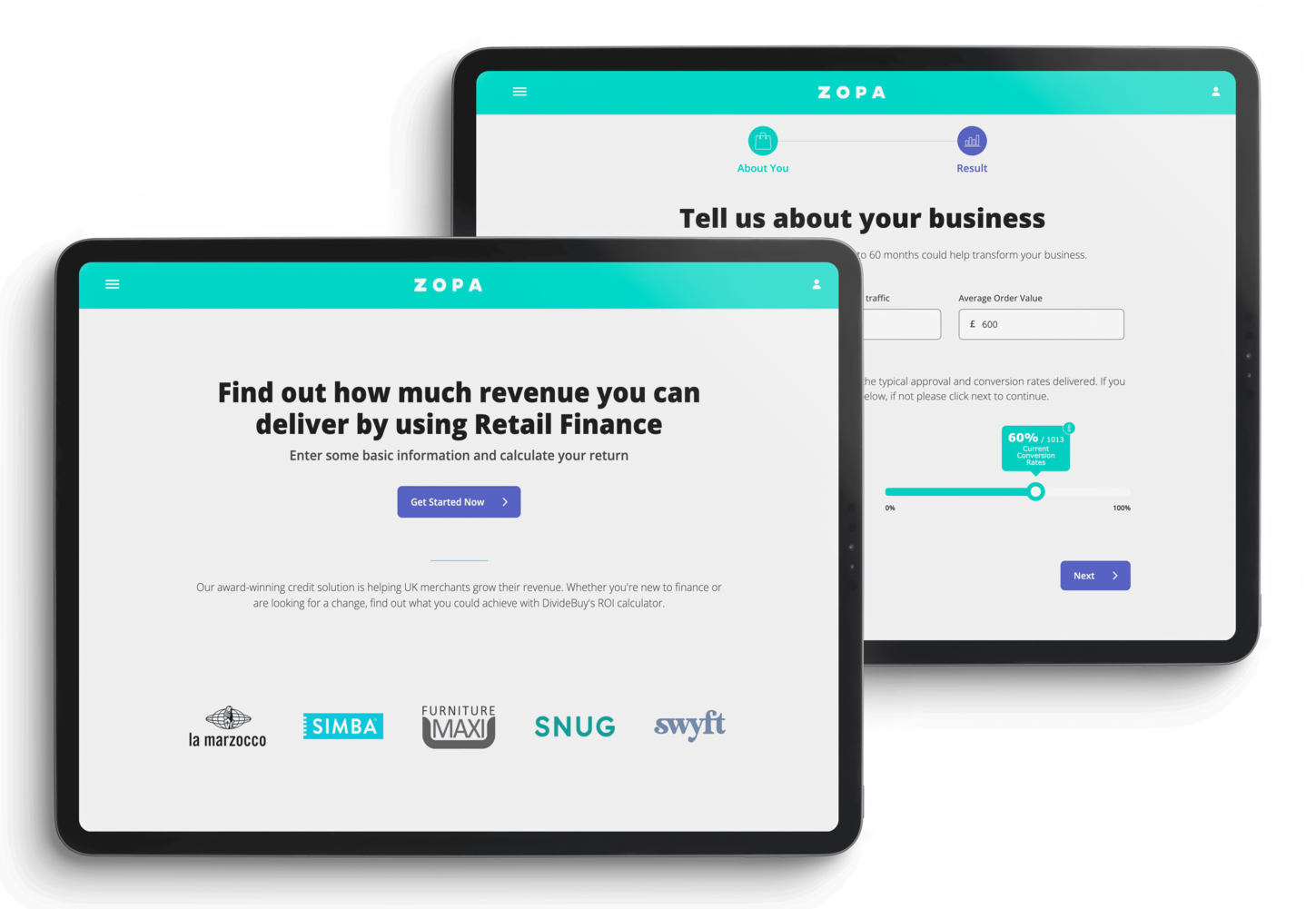

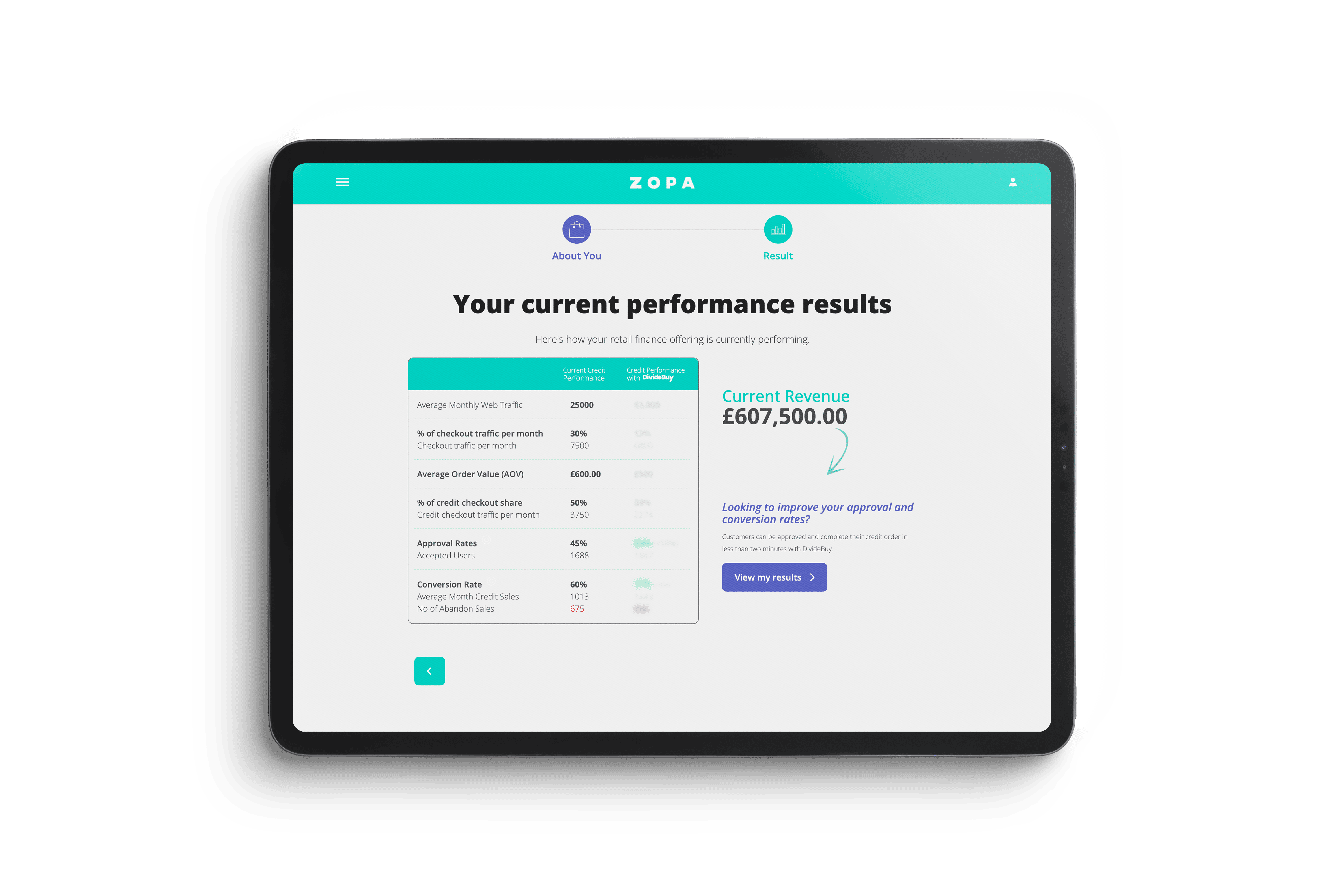

Our award-winning retail finance solution is helping UK merchants boost their revenue. Whether you’re new to finance or are looking for a change, find out what you could achieve with our Approval Calculator.

How does interest bearing credit work for businesses?

Interest bearing credit passes on the cost of borrowing to the customer instead of the merchant. It also lets them spread the cost of a purchase over longer period of time than most interest free credit options – making it ideal for high-ticket items.

Interest bearing credit is also worth considering if you have smaller profit margins on the products you are looking to sell with finance. When used correctly, it’s a great tool to increase sales and cart value.

Are there risks involved with interest bearing credit providers?

One potential downside of interest bearing credit from the consumer’s side is that if they do not complete their purchase in full by the end of the fixed period, they will need to make the minimum monthly repayment required, plus interest which may now be charged at a higher rate. Any missed payments may also result in a penalty charge from the credit provider.

At Zopa, we maintain ethical lending practices and don’t charge customers any late fees or additional interest for missing a payment. We also support our merchants with compliance issues that come with offering interest bearing credit, keeping you and your customers safe.

How can interest bearing credit help my business?

Most of our merchant partners choose to offer both interest free and interest bearing options. This covers their full product range, ensuring customers can access finance for any purchase (subject to minimum spend).

The benefits of interest bearing finance are higher sales, better average order value and lower marketing costs (as you won’t need to work as hard to convince customers to complete a sale).

Book a Demo

Our credit engine is so seamless, we can demo our solution in minutes. Experience our transformative customer journey in real-time and book a slot with our experts now.

What our merchants say

Read more about how we’re delivering results for merchants in your sector

Helping MuscleSquad drive a 545% basket value increase with flexible retail finance.

Helping customers spread the cost of levelling up by delivering high approval rates for students.

There was no lounging about on sales for Furniture Maxi with our retail finance solutions.

A Buyer’s Guide to Retail Finance

A Buyer’s Guide to Retail Finance