Looking to offer finance to customers, but not sure where to start?

Explore interest free and interest bearing finance options from 3-60 months.

See how our customer finance journey works in real-time with our interactive demo.

If you want to boost sales, win customers and increase your average order value, retail finance is the way to go. More shoppers than ever look for ways to spread the cost of a purchase when it comes to browsing payment options.

Giving your customers the choice of interest free or interest bearing credit options from 3-60 months (up to £25k) will give you a competitive edge and help turn more browsers into buyers. That’s where our retail finance solution, DivideBuy, comes in.

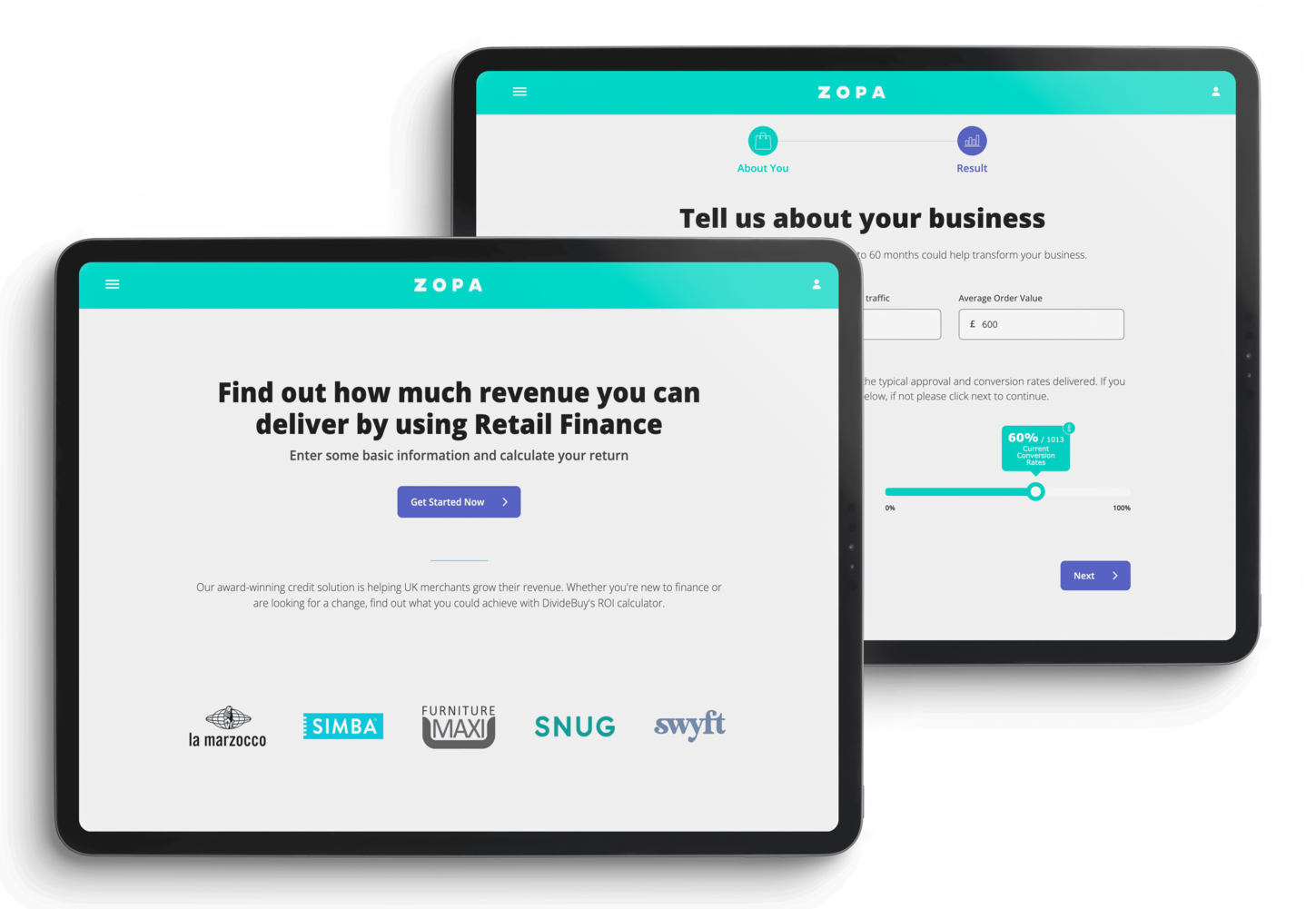

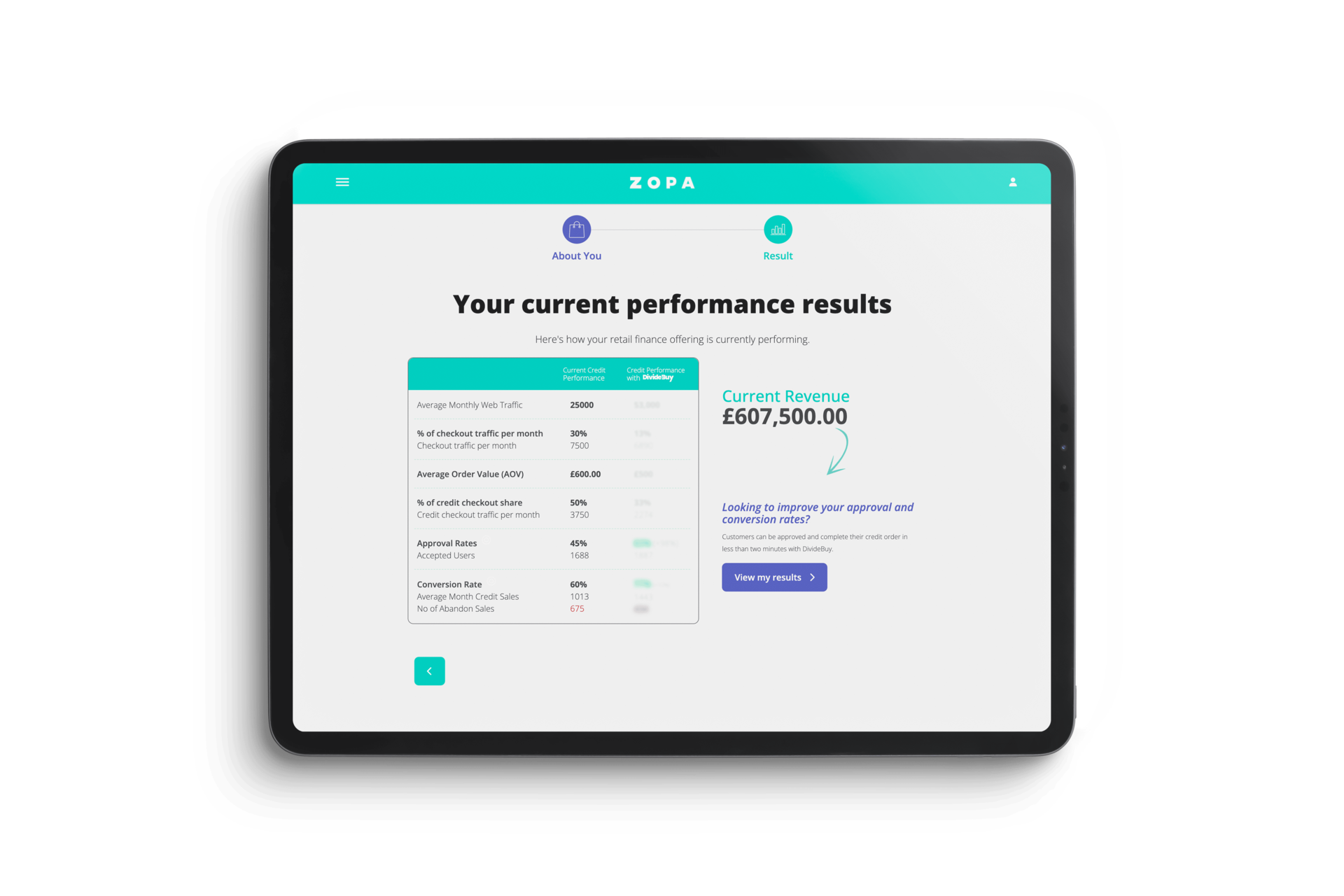

Our award-winning retail finance solution is helping UK merchants boost their revenue. Whether you’re new to finance or are looking for a change, find out what you could achieve with our Revenue Calculator.

What our merchants say

Read more about how we’re delivering results for merchants in your sector

AMC got in bed with Zopa to provide their customers with alternative and instant ways to spread the cost.

Lawn-term lending boosts revenue by 30% for Grass Warehouse thanks to flexible retail finance.

How we assembled AOV boosts of 73% for Cocoon with modular retail finance.

Try our Approval Calculator

Try our Approval Calculator